Originally Posted by

adam ali

Ok - I note if one went back one week in time, you'd find an additional three instances of market rally signals being generated:

5/25/04 - (1.40%)

5/30/00 - 5.90%

5/31/88 - 3.10%

6/17/76 - (0.10%)

6/4/84 - (0.90%)

To me, a bit inconclusive.

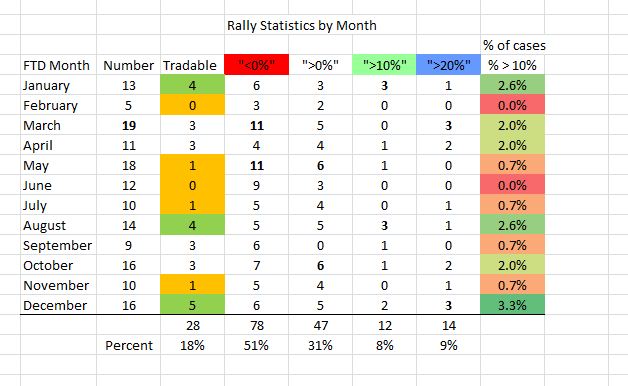

Here are all rallies including election years. The only May or June rally that added up to anything was May 4 1993 that went up 11.7%. I am sure if I could go back more than 40 years I could find some other examples. One day I will be in position go go back 100 years on the Dow.

Mike Scott

Cloverdale, CA

Reply With Quote

Reply With Quote