The triggervalue for the PM MF is now clear to me.

Thanks.

What about the 20DMF?

At what level will the 20DMF issue to buy signal?

Sorry for asking but I want to be sure...

The triggervalue for the PM MF is now clear to me.

Thanks.

What about the 20DMF?

At what level will the 20DMF issue to buy signal?

Sorry for asking but I want to be sure...

Hi Billy,

"The last consolidation was broken at Quarterly S1 (45.75) and Quarterly S2 is a logical temporary target for this selling wave."

I am wondering if the above statement can be generalized in your experience. ie. if consolidation happen @ [Q/M/S]N, then a likely support/resistance will occur @ the corresponding N[+/-]1 level.

Thanks.

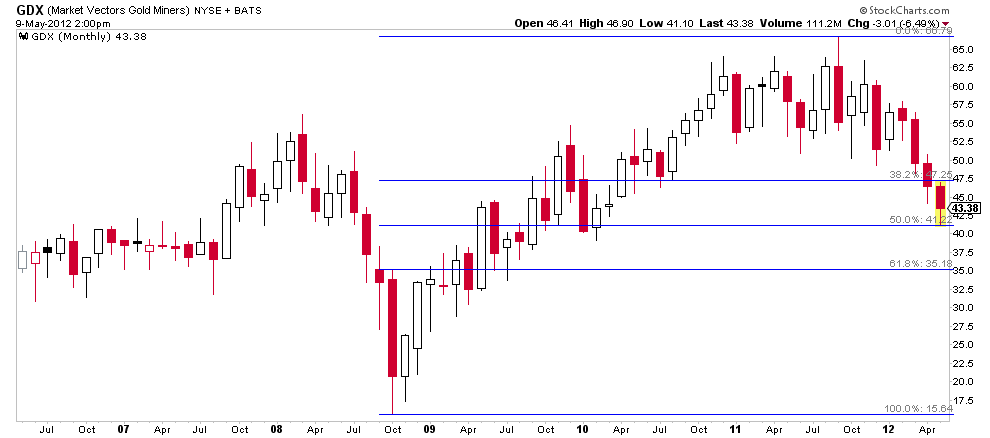

I think it's time to finally buy GDX. It has retraced 50% of the move from the 2009 low to the 2011 high. If today's lows don't hold in the next days I would guess next good buy point for GDX is at around $36, which happens to be near the h&s target from the weekly chart.

When humans used to program their own inventory plans, it was fairly reliable. We can just hypothesize that modern algos were build with that experience. Anyway, the longer the calendar period of the support/resistance, the more important it is. We still have the massive resistance of YS1+SS1 (44.77) waiting before QS1 (45.75) could be retested. Without that longer timeframe hindrance, QS1 would have become a logical target.

Billy

Pascal,

The 20DMF will go in BUY mode if the OB/OS is above -30 end of day, correct?

What is today the level of porosity for a 20DMF CASH signal?

PdP

Sorry to ask again, but is the OB/OS trigger not a move above -30 (minus 30) ?

The OB/OS signal allows to enter a "Short protected" mode when the OB/OS crosses below -30. This mode allows to force a BUY signal if we cross above OB/OS +30. This rule allows to enter a buy signal even when the OB/OS does not enter the oversold territory but bounces off from "close to oversold." This bounce is registered when OB/OS crosses above +30. The move between -30 and +30 is usually very fast, because this occurs when the whole market moves up and hence, all the sectors move up.

If the OB/OS for example comes down to -25 but then bounces from that level and above +30, then no Buy signal can be issued.

Pascal

The 20DMF Buy signal would be on a close above on OB/OS above 30.

A 20DMF Cash signal would occur if we cross above 0.11% before the buy signal is issued.

As far as I can see, a Cash signal has higher probabilities than a Buy signal.

However, I expect some last minutes selling as day traders - who have been long - leave the market by the close.

So the 20DMF would probably stay short tomorrow.

Pascal