-

"Trading Around" Study for FB, wait and see if downside risk is off.

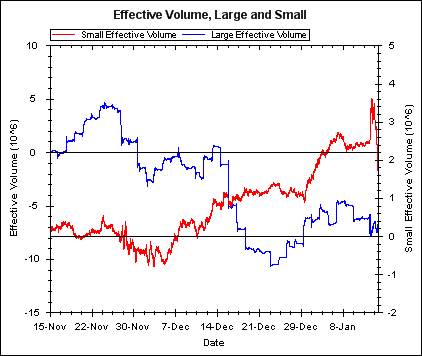

To my long trading input on Comment of the Day, 1/12/2018. Looking at FB plots I provided, I have observe the Small$ impulse transient response to the latest pullback tied to the FB decision to shift out of News Feed ad base. Have a look.

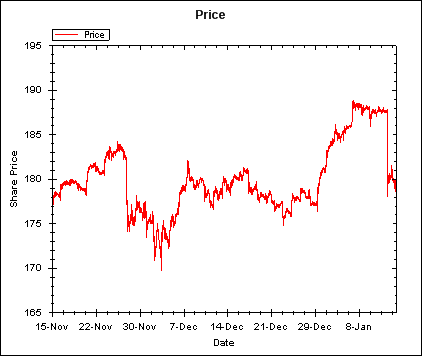

I bought into FB 50 sh on 12/5 and 50 sh on 12/14.

12/5, Both Big and Small $ trends turned up while the price was low. Take a position and see if there will be another transition to layer on.

12/14, Big & Small $ trend up again. Finish my allocation goal with another 50.

Who would know the B$ decline begins the next day! Who did it? Zuckerberg & associates selling a portion of their holdings. go check the SEC filings for FB. I figured out the reason for the B$ exiting and believed the Small$ algo trading function was not going to allow the price to collapse, as you see, the selling (I counted 15 M of negative EV change, there was more sold though) went well. I'm thinking all's well now. But, after Zuckerberg had his head handed to him at the Senate hearing and the insiders decided how to appease Congress membership for the safety of a democracy, their nests were lined and a day was chosen to announce the shift in the business of advertising.

In general, not always absolutely true, Small $ manage the FB price (The evidence is in the 1 year plots I generate, but did not furnish). At times, Big$ have influence the price motion. As you can observe in the last few trading days, Small$ transients changed the price, Big$ hardly flinched. May have been an orchestrated Big$ move to reinforce Small$ expenditure?

For me, I'm roughly $3 per sh to the good. I'll wait to see what the next trading day and EV analysis brings me before I decide to stay or leap out with my shirt still on.

Before taking a new position, one should wait and see how this transient settles out. It could continue the decent and will if an analyst publishes a downgrade related to Zuckerberg's business decision. Or Big$ may view the price drop the opportunity, after the future projected fundamental analysis is completed. Need to wait.

Additionally, many other stocks have been demonstrating well behaved ebb and flow patterns for last several months, except for AMZN (perpetual climax, now too dangerous to enter). Steve

-

EV Still very negative today.

Pascal

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote