-

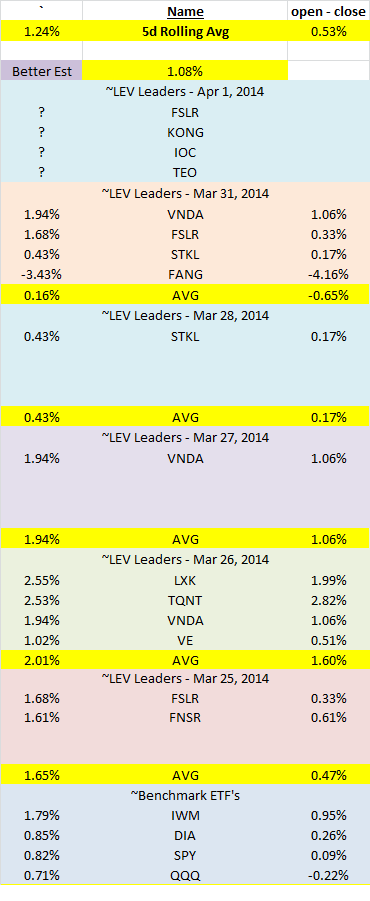

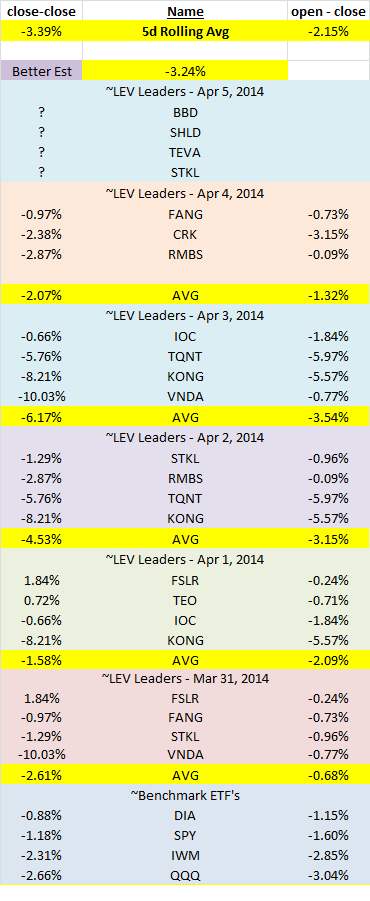

LEV Leader Performance - Mon, Mar 31, 2014

Hi-

Shawn

-

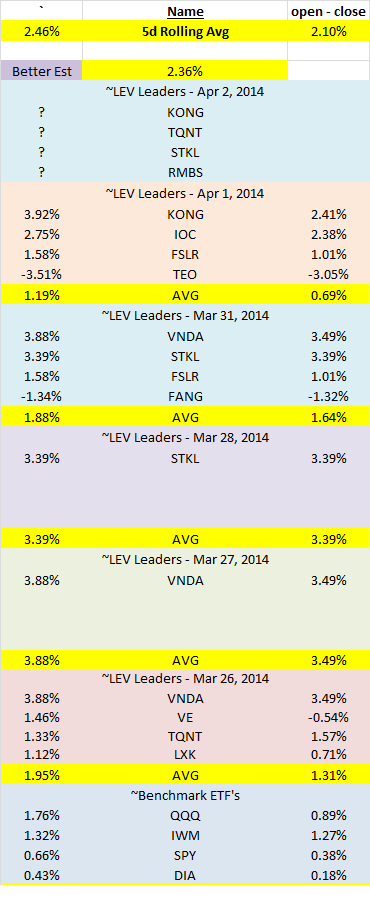

LEV Leader Performance - Tu, Apr 1, 2014

Hi-

Shawn

-

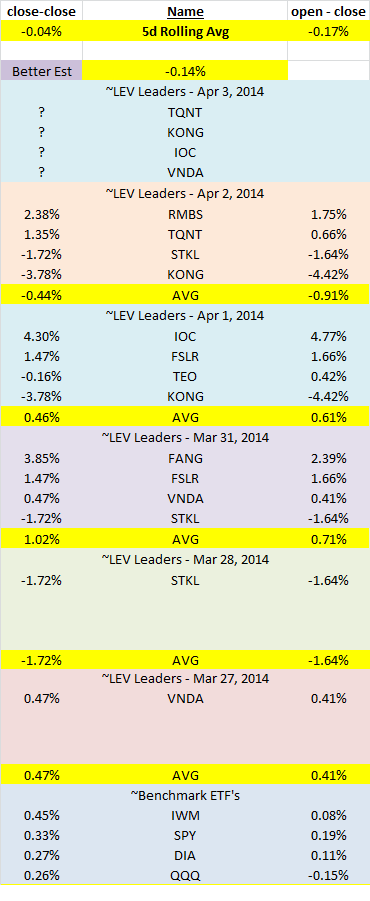

LEV Leader Performance - Wed, Apr 2, 2014

Hi-

Shawn

-

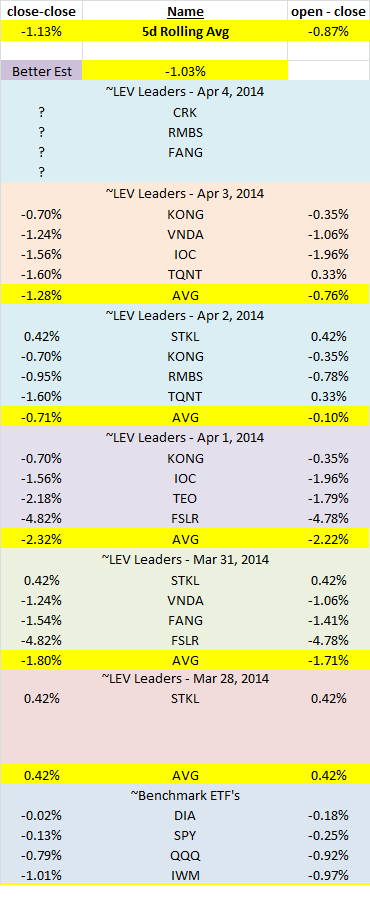

LEV Leaders Performance - Th, Apr 3, 2014

Hi-

Shawn

-

LEV Leaders Performance - Fri, Apr 4, 2014

Hi-

Shawn

-

Any Trade on Nifty or BSE / Nse Stocks?

hi

how will it perform in Nifty or BSE / Nse Stocks?

Any trade history on that?

thx

CS

-

Nifty, etc - other exchanges

Hi-

I have not done work on exchanges outside the marketsmith.com database - which is comprised primarily of US names. Note today there are 2 Brazilian companies and an Indonesian ETF as today's LEV leaders- these names are all traded on US exchanges.

Each night, a universe of about 2,400 names are scanned. The universe of stocks was pulled from the marketsmith.com database according to minimum price and volume cut-offs. I do that in April and Nov each year b/c there are new ipo's and mergers that change the composition. I will be doing the April re-creation of the universe of stocks soon.

These names are the highest beta names in the marketsmith database (the top 4 names with 3 month RS +95) that have shown large institutional accumulation over the last 20d (the LEV work).

I traded these names for a couple of months at the beginning of 2014, and suffered rather large drawdowns - the paper results and actual trading results only varied by about 0.07% per day due to slippage, commissions, etc.. So, I consider the paper results to be representative of actual results. At this time, I cannot recommend this methodology as a mechanical trading system. Pascal has suggested an overlay for market direction would improve results, e.g. if the 20d is on a sell, do not go long.

In any event, I find this list of names helpful in my personal trading as a watch list (e.g. it uncovered TSLA early for me) and most particularly, as an early indicator, of market performance - on daily and intraday timeframes. For example, in the first 10-15 min of the trading day, if the LEV leaders are deeply red, its highly likely that its going to be a bad day in the market. We can also see the LEV leader performance has been quite poor for weeks, and now the indexes are cracking.

Thanks,

Shawn

-

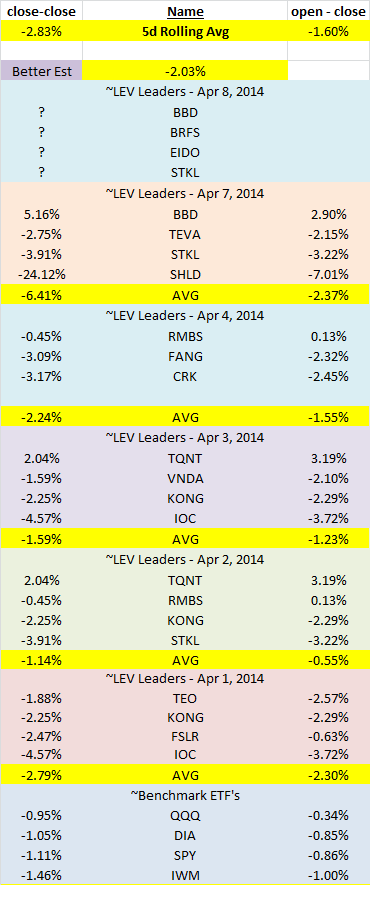

LEV Leaders Performance - Mon, Apr 7, 2014

Hi-

Shawn

-

What is the basic idea behind LEV Ladder?

hi

What is the basic idea behind LEV Ladder?

How you are taking trade decision using it?

thx

CS

-

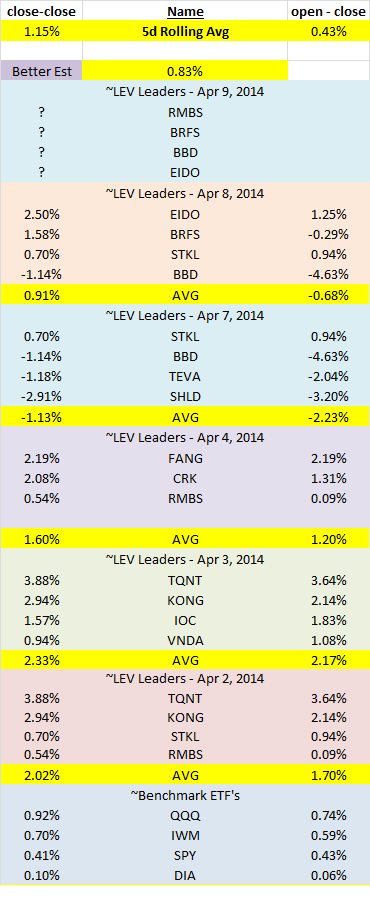

LEV Leaders Performance - Tu, Apr 8, 2014

Hi-

Results for Tu, Apr 8, 2014

Shawn

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules