-

Calculating the effect of the QE taper on S&P valuations

From: http://market-mousetrap.blogspot.com...-qe-taper.html

Bernanke has declared that all quantitative easing should be tapered to zero by the end of 2014. But Bernanke isn’t going to be in charge. We cannot know what Yellen will do.

With nothing else to go on, though, let’s assume that the taper follows Bernanke’s declaration. Will the world end?

These three sites certainly think so:

https://www.tradingview.com/v/cFnIIKNf/

http://www.minyanville.com/business-...2399?refresh=1

http://www.zerohedge.com/news/2013-0...and-without-qe

But if you’ll look carefully at those sites, not one of them is using any kind of model to show what the S&P should be under normal circumstances.

By normal circumstances, I mean – driven by the economy. The market hasn’t had much to do with the real economy since 2008. Oh, corporate earnings are through the roof, but folks aren’t working.

So, what WOULD an economically driven market look like?

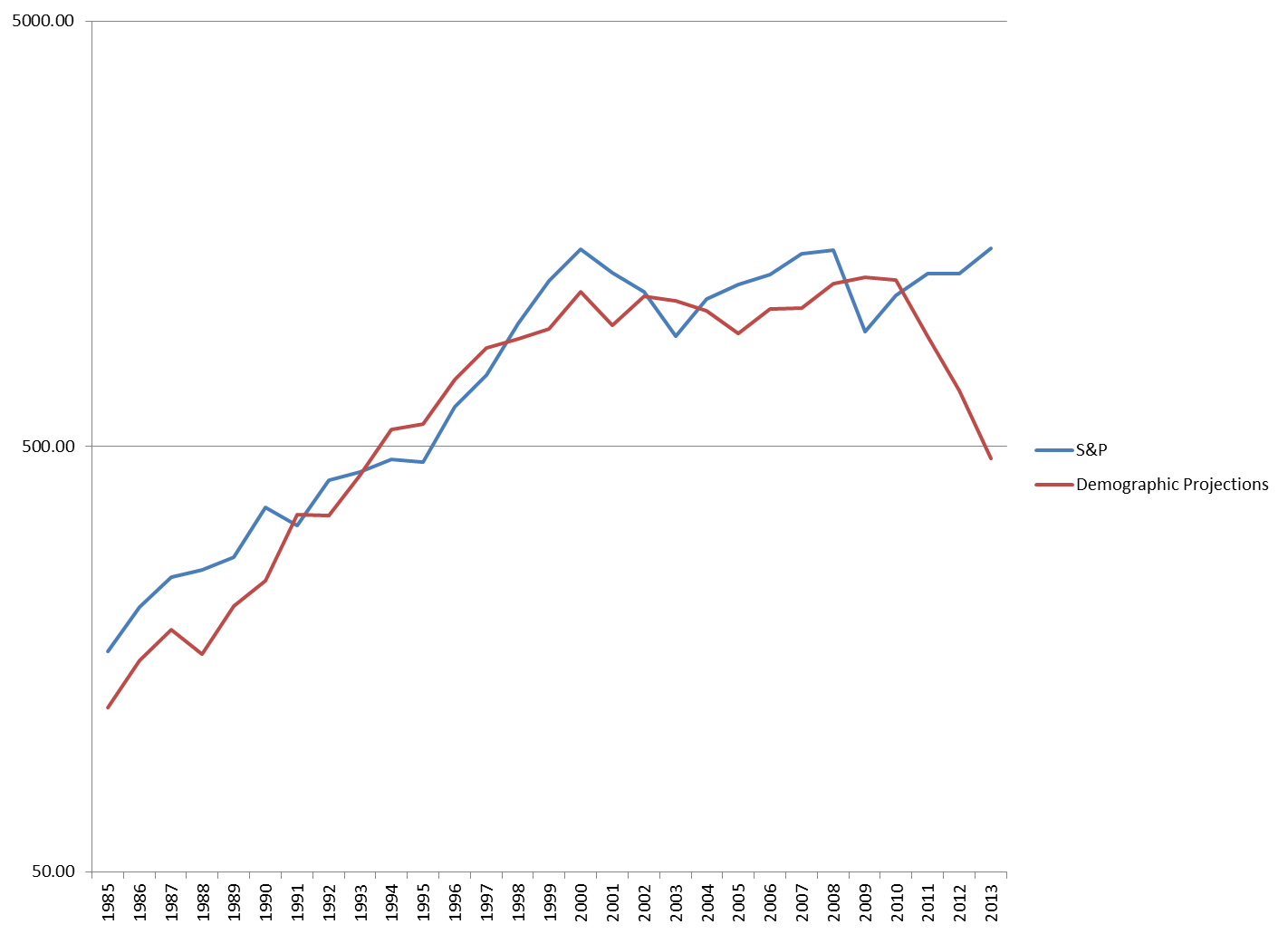

Ugly:

The basis for the “demographic projections” is the ratio of working age to non-working age citizens. I’ve used this ratio much like an Earnings Yield to develop a long term Demographic Yield. If people drive economic growth, then demographics can be used to estimate future growth based on existing birth rate records.

The model works well from 1985 until 2009 – when Quantitative Easing skewed valuations. Instead of people creating money, Bernanke just started printing it.

But what happened to the people to throw us into a path that could have led to another Great Depression?

To put it bluntly, the baby boomers aborted 50 million babies and there aren’t enough people to pay for their retirement.

This would have looked like a Greek Tragedy had not Bernanke pulled his Deus ex machina to save the day.

I’ve measured the effects of QE in a previous post.

http://market-mousetrap.blogspot.com...-bernanke.html

Basically, QE is the difference between that scary looking red line and the happy blue line we’ve actually experienced. It’s like the difference between the red pill and the blue pill in the Matrix.

In any case, now that we are facing the taper, what the HECK should it look like?

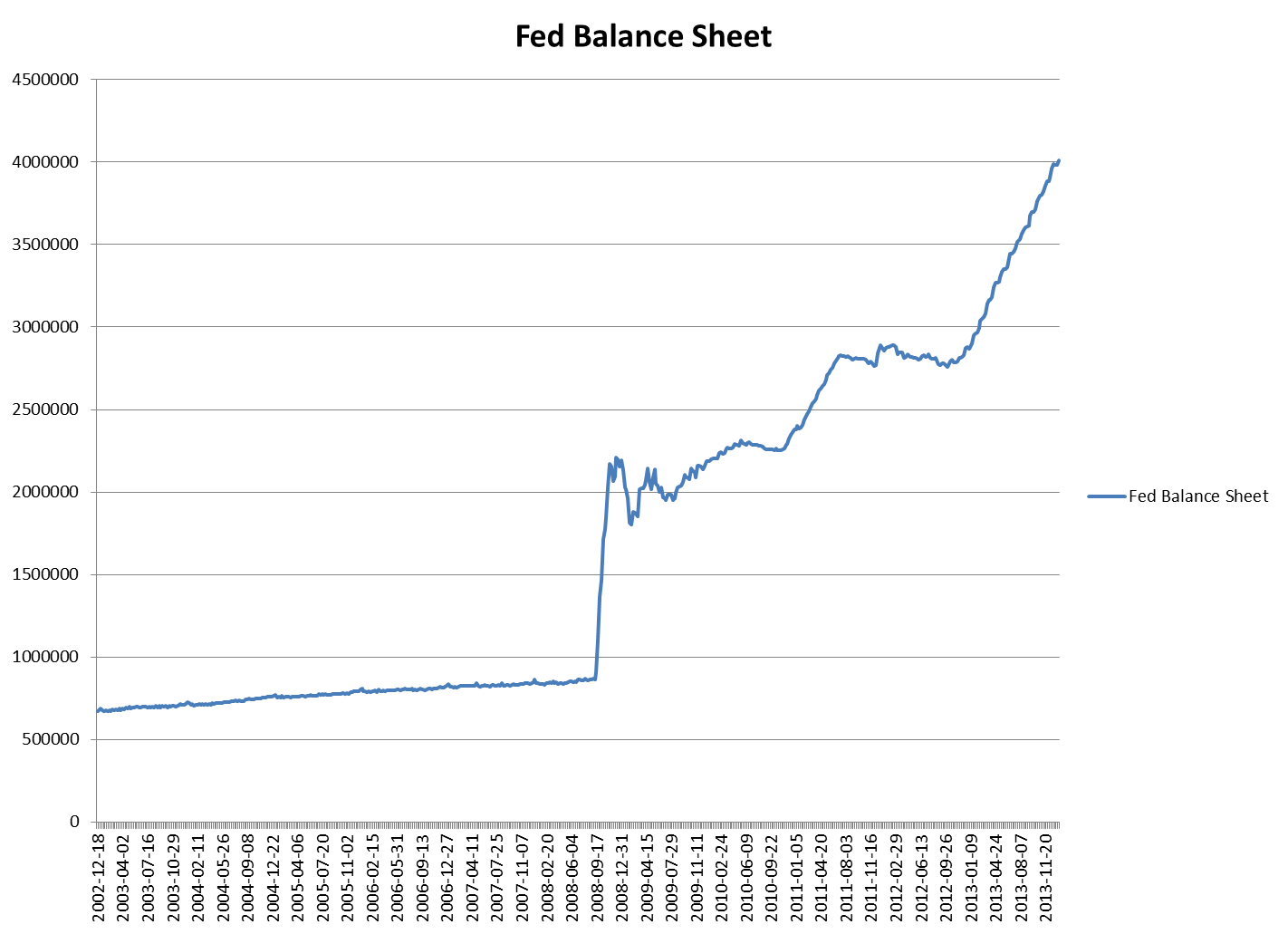

For that, we need some hard data about the Fed’s balance sheet:

http://www.federalreserve.gov/datado...t=seriescolumn

Here’s a graph:

Until the economic crisis, the Fed balance sheet was expanding at something similar to the rate of the economy. The average for 2003-2008 was 4.67% a year. Then – BOOM! – by 2009 we had a whopping 149% increase, and it keeps on going. Just last year the Fed balance sheet increased by 38.74%.

If Bernanke’s taper prediction comes true, 2014 will STILL see an increase in that balance sheet by another 13.96%.

After that, my best case scenario would be for the Fed to maintain that balance sheet until 2024:

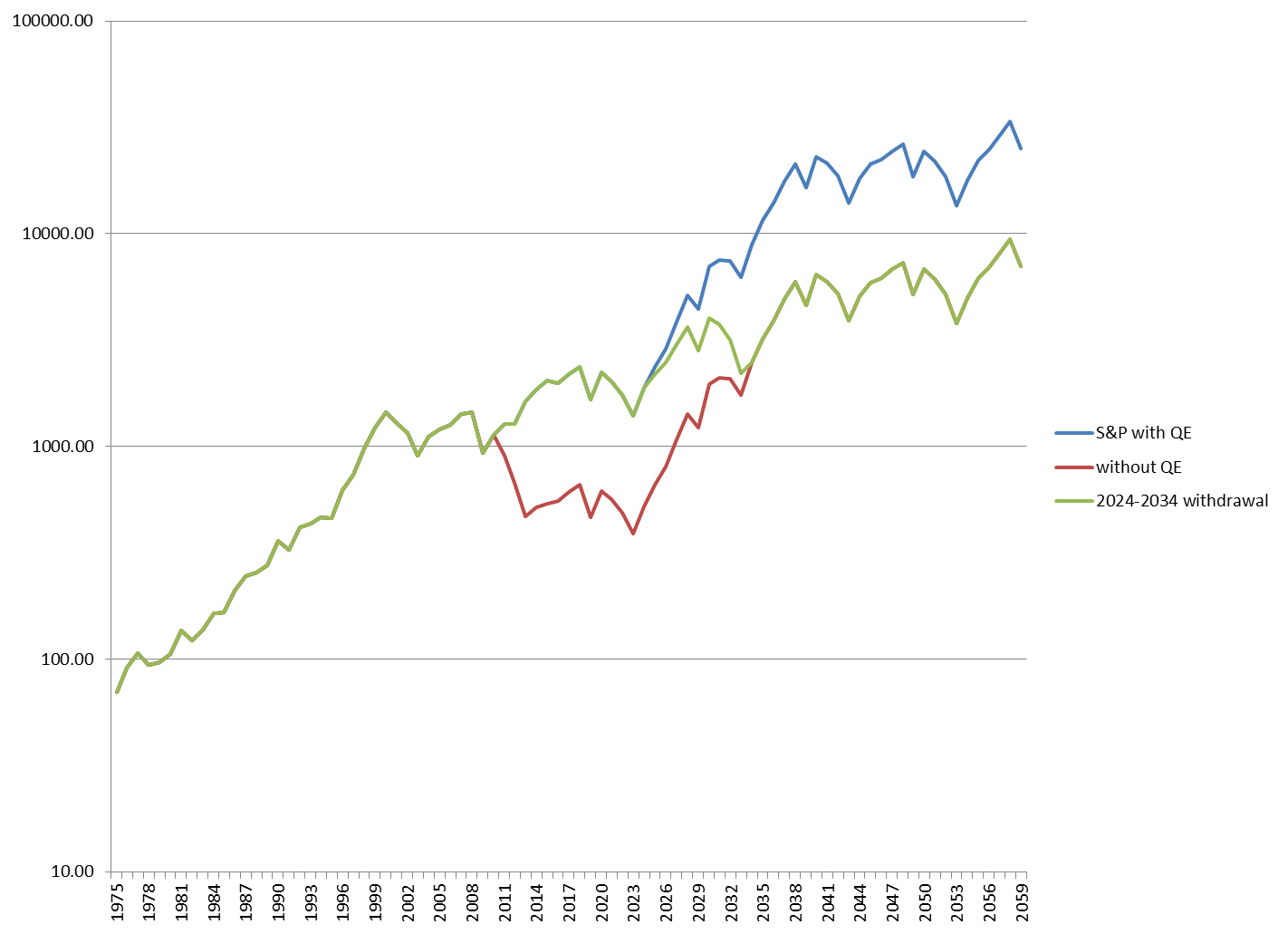

I’ve updated the S&P projection graph to incorporate Bernanke’s proposed taper, and MY proposed maintenance of the balance sheet until a 2024-2034 withdrawal.

The current projection also includes a normalized increase in the balance sheet by 4.67% each year until that withdrawal.

Given those ideal conditions, we would see something like this for the S&P (note the higher numbers from previous estimates to include the entire projected QE):

2015 2050.71

2016 2101.69

2017 2326.07

2018 2508.94

2019 1763.98

2020 2360.19

2021 2149.77

2022 1862.23

2023 1480.70

Now you see why I suggest we maintain the balance sheet until 2024. Can you imagine the S&P back under 1500 even MAINTAINING the current balance sheet?

It would be far worse if they reversed all QE and worked down that balance. The S&P in 2023 would be well below the March 2009 apocalyptic value of 666, and would likely go post-apocalyptic to something closer to 400!

Let’s assume the good Janet Yellen isn’t fired in 2016 by a President Rand Paul… and the sun and moon don’t fall from the sky…

Given that ASSUMPTION, there IS a slight demographic uptick in the working age / non-working age ratio between now and 2018. That means we should have moderate economic expansion.

Hence, the taper. That is – the S&P could go above 2500 by 2018 even if we taper QE to zero.

Of course, we do not know, and CANNOT know, what the Fed will ultimately do. I’m only showing the range of options between a sane taper and an insanely premature reversal.

I keep saying this, but cannot say it enough: don’t fear the taper! Any REVERSAL before 2024 would be disastrous – but no one is talking about that yet, and it won’t happen this year or the next.

2016, though, brings another Presidential election. We elected a left wing ideologue, and we’re surviving it. But please – no more ideologues. Too far to the left and we’ll get massive inflation in the NEXT decade. Too far to the right and we’ll get massive deflation in THIS decade.

If I were Bernanke, I’d be retiring too. At some point it’s beyond his hands.

And may God have mercy on Yellen’s soul.

But we’re okay this year and the next. We’ll have some scares, and I expect a good correction to make most investors wet their pants. But the sky won’t fall, and the ground won’t swallow us up – at least, not yet…

Now for some caveats:

These are just estimates on a model. I’m using the Fed balance sheet as a multiplier on my own Demographic Secular Model. This appears valid in the 2008-2014 time period, but that’s too short a time to truly qualify as a multiplier on a secular model (which by definition works in sequences of decades rather than years).

Even if valid, the numbers are mere approximations. As you can see on the first graph (above), even the most accurate projections are never a bullseye.

You cannot, therefore, use such long term estimates to do any kind of short term timing. I’m “timing” in decades instead of years. We face the continued threat of deflation in this decade, and the threat of inflation in the next.

That’s really about as far as anyone can go. The purpose of this post is NOT to say what the market must do, but rather to answer the common fears in recent articles that the taper will bring immediate disaster. Disaster would require something far more than a taper; it would require full reversal of QE and an elimination of the Fed balance sheet – something which must not occur until the 2024-2034 time period.

Tim

Last edited by Timothy Clontz; 01-20-2014 at 01:15 PM.

Reason: placing graphs inline

-

Tim. Thanks for sharing this and your other work.

You mention "normal" circumstances, and I am wondering if your view is that the economy drives the stock market or if changes in the stock market drive the economy? It is something I've been thinking about lately. Also, I took a look at the historical unemployment rate going back to 1950. It seems that once things are booming and unemployment is low is the time to be selling. It was 3.8% in March 2000, not a good time for investors.

Could changes in US fiscal and/or economic policy change your model's outcomes?

I'm trying to get a better grip on economics, but it is a bit tedious.

Thanks again.

-

Extremes

You're right that the economy mean reverts.

What I was trying to say is that the economy itself is driven by the ratio of working age / non-working age people in the population.

People who don't work consume more wealth than they produce. People who do work produce more wealth than they consume. That works at the household level, and also at the national level.

The key demographic for employment is the 35-55 year old range (not mentioned in this last post, but mentioned in an earlier one). People younger than 35 can take risks, but have no capital. People older than 55 have capital, but can't take risks. There are exceptions -- but the rule of thumb is that in order to START a business you need both capital and risk taking. Most small businesses (and most jobs created by them) are started by people in the 35-55 year old range.

THIS, I think, is what drives the economy.

-

Thanks Tim. Appreciate your reply, and thanks for sharing your work, too.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote