-

87 in +511 Club & 24 Names are RS +80

Hi-

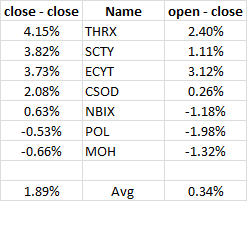

I was 71% long-invested coming into day; and I am now about 75% (as can be seen below in the close-close vs open-close #'s'; today's gains were primarily on the morning gap and the market could not be day traded for great profit this Th)

Extra commentary: biotech, M&A (due to rising interest rates) & solars.

I have 20% of my accts in FBIOX (biotech) and GABAX (Gabelli is excellent at M&A catalysts).. M&A is on the rise b/c CEO's are like home buyers, CEO's are looking to buy companies before interest rates get back to normal. I do NOT own home builders or related.

On Solar, no good ETF or Mutual Fund vehicles I know of .. so, I own SCTY and should own ECTY (+511 names both). Smart people I know tell me to watch this space (I do try to be cautious with Chinese companies).

LNKD seems to be the most important large cap growth story to own for mutual fund managers (price & volume today says this). I have a similarly sized position in GOOG, although I believe LNKD will be higher (%-wise) by end-of-year.

TSLA, of course, is this year's AAPL - its a must own... and I have stock and Jan 2014 calls..

I have a few other individual biotech names in my portfolio b/c they are just getting it done.. THRX is the biggest individual biotech I own and that is b/c it has been a consistent LEV player on the +511 list.

SSNC was on +511 list for many days, and is a larger position of mine which I entered based on +511 status last week.. again, SSNC is getting it done without worry.

Here are today's specific results:

For Fri:

+511 Club's - Ju1 11 (day of run), 2013.xlsx

Take care,

Shawn

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote