-

01/01/2013 Final Mousetrap Numbers

Small Portfolio XLF & IAU 17.74%

Sector XLF 27.01%

Secular IAU 8.46%

Large Portfolio Date Return Days

RIMM 7/16/2012 63.72% 169

SEAC 9/25/2012 18.36% 98

CAJ 9/25/2012 13.98% 98

DDAIF 9/25/2012 5.94% 98

CFI 10/31/2012 26.88% 62

RE 11/26/2012 5.08% 36

CGX 12/12/2012 1.84% 20

PAAS 12/20/2012 4.70% 12

OKE 12/28/2012 1.40% 4

STRA 12/31/2012 1.54% 1

S&P Annualized 3.75%

Small Portfolio Annualized 10.81%

Sector Model Annualized 16.22%

Large Portfolio Annualized 27.20%

From: http://market-mousetrap.blogspot.com...l-numbers.html

I dreamed I worked in Washington D.C., complete with a New Year party in which I coached a Senator on how to apologize for a slight he made to Barbara Bush over twenty years ago, just before I went parasailing over the beach in the snow.

When I awoke I realized the dream was not nearly surreal enough to fit the location.

So, Happy New Year to the same old crowd arguing over how much of our retirement money to legally steal. We’ll do our part and try to survive it.

The President stayed true to form and did his best to sabotage any agreement the congress could make, while Biden and McConnell acted like the only two adults in the room. Interestingly, Bob Woodward’s “The Price of Politics” paints Biden as the responsible adult compared to Obama. One would never guess by how they appear on TV news…

The model ended the year with a bang, capturing an annualized return of 27.20% since it began on May 31, 2011. That represents the following TOTAL returns from May 31, 2011 and their annualized advantages over the S&P:

S&P Total 6.02%

Small Portfolio Total 17.74%

Sector Model Total 27.01%

Large Portfolio Total 46.63%

Small Portfolio Advantage 7.06%

Sector Model Advantage 12.47%

Large Portfolio Advantage 23.46%

This does NOT count taxes, of course.

So what’s the big deal?

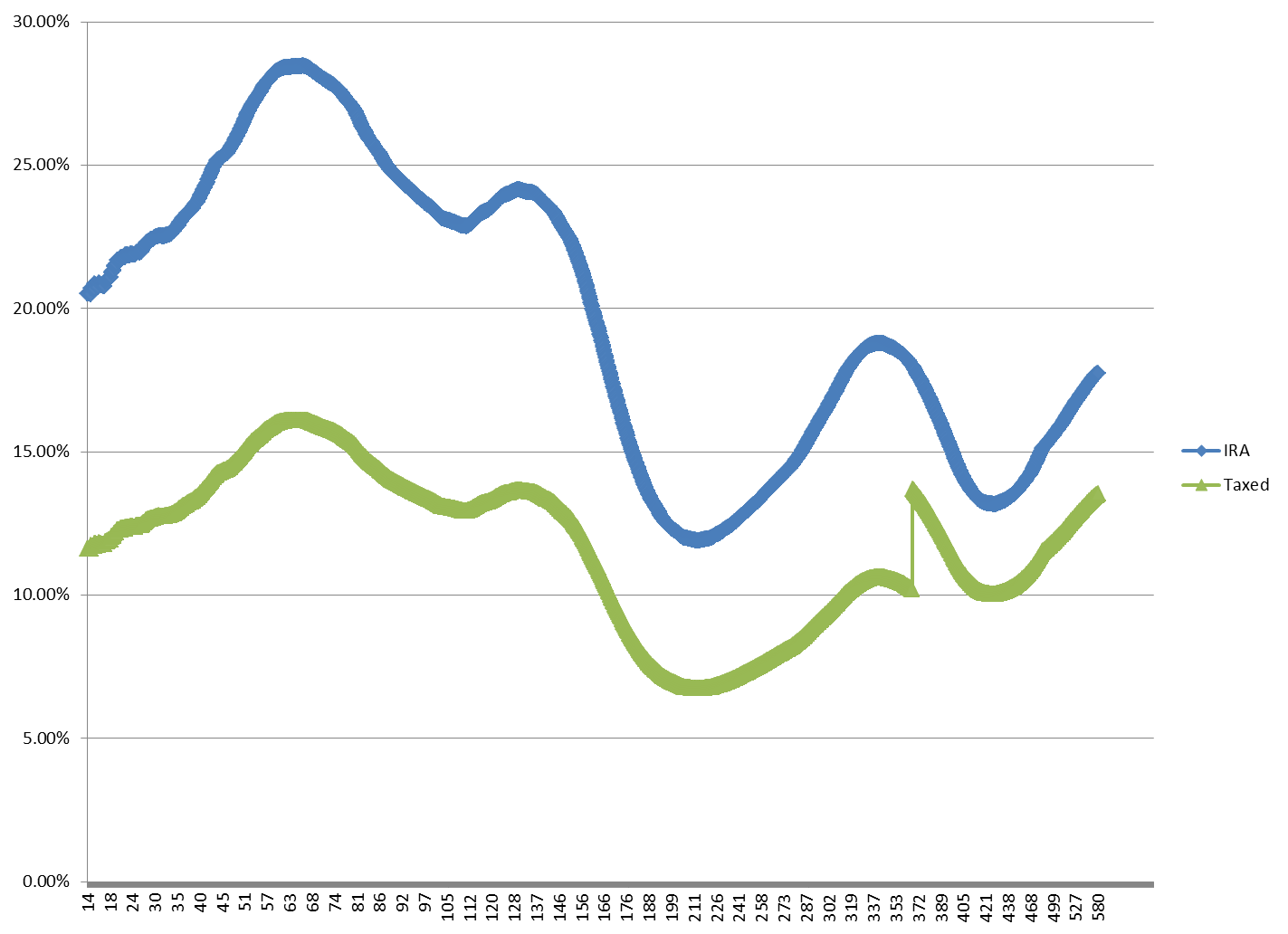

This shows the relative returns for any given holding period. The Blue IRA line shows the return rates for an IRA account (after trading costs). The Green Taxed line shows the return rates for a regular account (after trading costs and taxes). Both are currently optimized at a 66 day holding period (the maximum point for each line).

This is a slight alteration on the earlier graphs because I’ve backed out the annualized return rate for SPY for any given day and then re-added the average annualized return rate for SPY to normalize the curves…

Another alteration is that I’m using the Obama rates of 43.40% for short term rates and 23.80% for long term rates (this adds the Obamacare surcharges to the 40% and 20%).

Oh, you didn’t know saving for retirement was a health hazard?

It is now…

Added to this is the problem that Washington is now trying to further restrict your ability to add to your own IRA account. They are trying to impose a limit of $20,000 or 20% -- whichever is less.

By the way, I haven’t even factored in the problem of inflation, which is a tax on your entire net worth. All that money the Fed is throwing out just to Band-Aid over the President’s economic incompetence will eventually gain traction and your retirement will be further eroded, because inflation reaches into EVERYTHING, including that IRA account.

Whenever the inflation wave comes the safest havens will likely be Asian, Australian, and Canadian stocks. But even after you ride it out you’ll be taxed on the “gains” you supposedly made (which are worth no more than they started in real value, but will be taxed as if they were).

Repeat after me: STOP VOTING FOR LAWYERS!!!! I don’t care if you’re a Democrat or a Republican, lawyers can NOT do math. That’s WHY they became lawyers instead of engineers.

Oh well. We had our chance and voted for a lawyer anyway.

Don’t get me wrong. Some of my best friends are lawyers. Nice people. But you DON’T want them calculating a tip or your tax return.

And that energy boom that could save the economy? We re-elected the one law professor who might be able to stop it.

It’s a New Year, and a new normal.

The Reagan revolution is dead.

We may need Obamacare if all we can afford to eat is dog food.

That is, unless old age is deemed to be a poor risk / reward benefit for treatment. Oh, yeah, I forgot.

For what it’s worth, my wife is a doctor. She doesn’t bring home 250,000 a year. Put together we don’t bring home 250,000 a year. But the tax RATES the President wanted to raise would have hit us anyway because she is a small business, being taxed as an individual even before she pays herself and everyone she employs what salary is left over. That’s what the tax RATE arguments were about in Washington.

The loopholes are designed for individuals, and closing them wouldn’t have harmed small businesses, while raising rates would.

The President has never worked in the private sector, and never owned a business.

And he’s doing his best to make sure you don’t either.

The real unemployment rate is actually at 15%.

Inflation is waiting in the wings.

Washington is trying to eat your retirement and kill your job too.

The Mayans weren’t so far off after all.

Oh, and Buffett? Why does Warren Buffett, who has too much money to trade and doesn’t ever cash in capital gains want to raise capital gains rates on the rest of us?

Simple. We’re his competition. The less money we have, the more powerful his holdings are.

The President is not your friend.

Warren Buffett is not your friend.

Bernanke is not your friend.

It’s time to stop hoping, to roll up our sleeves, and to navigate around this disaster. Your retirement, your job, and your survival, are in your hands – not in the hands of D.C.

Okay, I’m through ranting over the latest apocalypse.

Happy New Year!

Tim

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote