-

06/23/2012 Mousetrap - two changes

Condition Bear Market

S&P Target 1280

Small Portfolio IAU & XLF 4.14%

Margin (short) XLK 5.03%

Position Date Return Days

GCI 7/14/2011 4.01% 345

CSGS 10/3/2011 34.73% 264

NLY 10/25/2011 11.81% 242

KBR 10/27/2011 -17.97% 240

VG 10/27/2011 -42.86% 240

BT 1/4/2012 2.79% 171

PDLI 3/7/2012 8.91% 108

SAI 5/30/2012 7.04% 24

XEC 6/5/2012 -1.91% 18

DECK 6/15/2012 -6.23% 8

S&P Annualized -0.71%

Small Portfolio Annualized 3.89%

Mousetrap Annualized 4.66%

Margin Annualized 9.39%

http://market-mousetrap.blogspot.com...k-changes.html

NOTE: selling PDLI and buying FCX on Monday.

ALSO: covering the 100% short position on XLK and adding a 10% long position in XLF.

Both are explained belowÖ

Any trading system has a number of elements that need to work in harmony:

1) The technicals (i.e. money flowing into a stock through investor interest)

2) The fundamentals (i.e. money flowing into a company through business)

3) Exit criteria

4) Position size

Iíve worked on each of these in turn and have finally reached the fourth: position size.

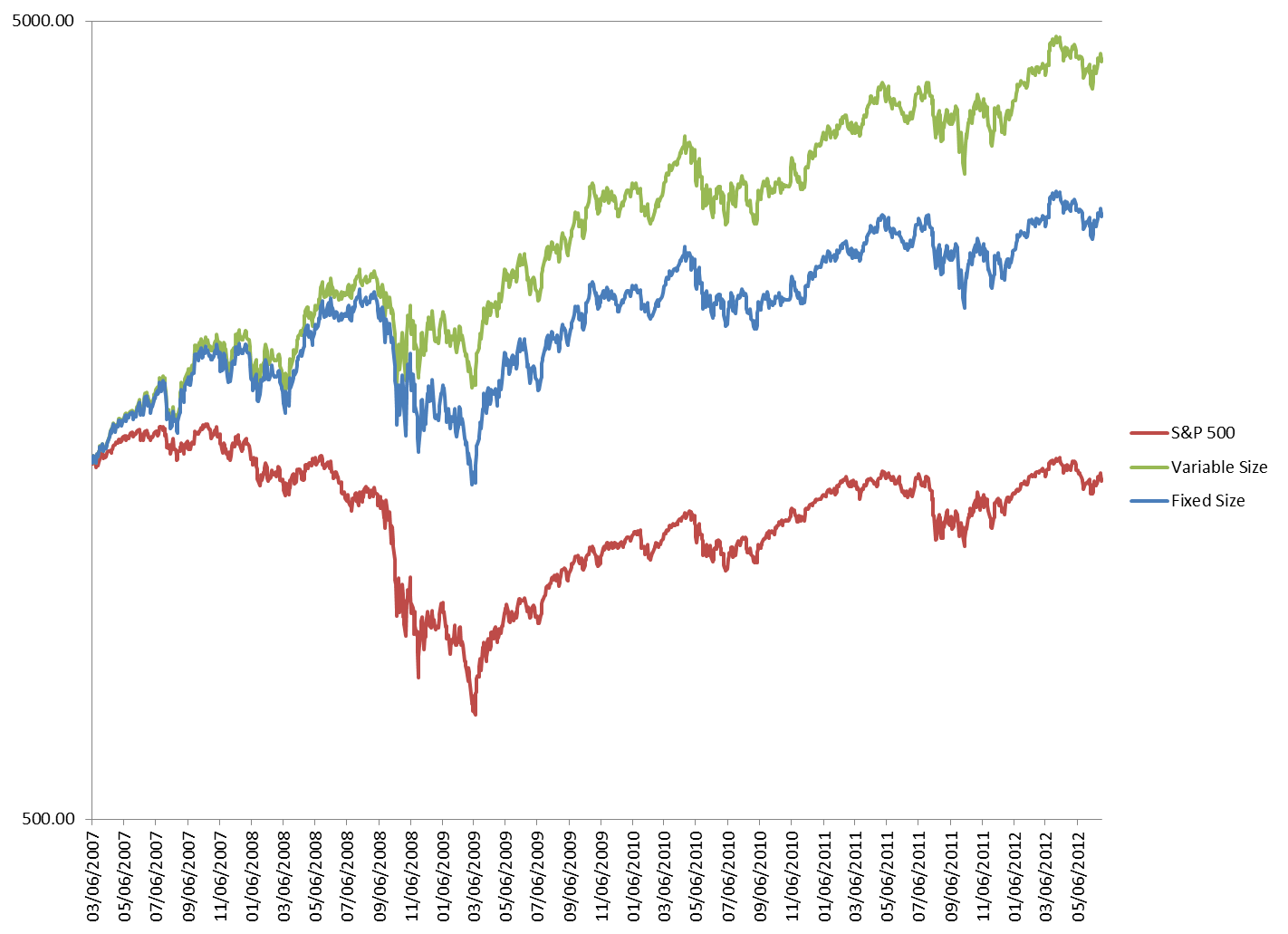

In tests of the basic sector model, a fixed size at 100% invested outperforms the S&P, but a variable sized position, ranging from 78-130% invested has less of a drawdown and better returns (i.e. less risk and more reward).

Back tests are one thing Ė and live tests are quite another.

In any case, Iíve thought long and hard about this, and there is no good way to properly apply the variable investment allocations in the Mousetrap investments. They will remain as before: 10% of the size of the portfolio, each.

What will change is the way I report the margin.

Instead of:

Margin (short) XLK 5.03%

It will become (on Monday morning):

10% Margin XLF (long) 5.03%

Thatís a little more information than youíve been getting. Right now Iíve simply been hedged: 100% long the Mousetrap stocks and 100% short XLK. The Margin will no longer be either fully hedged or in cash, but will instead either be partially long or partially short.

If the size of my portfolio on the variable sized model is supposed to be 90%, for instance, instead of selling one of the Mousetrap stocks I would be 10% short XLK. However, right now the variable sized model is calling for a 10% long position on Margin.

At the current price itís actually 9.31%, but Iíll round it to 10%.

In addition I will make a mid week post on the blog to show limit order settings to add or take away from the margin position. Iíll start with 10% increments, but I may end up doing 5% increments. It depends on how often the margin sizes would trigger a trade. I really donít want to trade more than I have to.

Also, by making limit orders I can set it at night and forget about it during the day.

Finally, on Monday I plan to sell PDLI and buy FCX, Freep't-McMoRan C&G in the MINING industry. Theyíve been slammed in the deflation scare and look like a good bargain at the moment. PDLI is in the drug industry, and looks to have gained some price in anticipation of good news from the Supreme Court this week. Instead of selling the news, I plan to sell before the news.

Iíll be on vacation this week. Have a fabulous week and good luck in the market!

Best,

Tim

Last edited by Timothy Clontz; 06-24-2012 at 09:52 AM.

Reason: added graphic

-

on second thought...

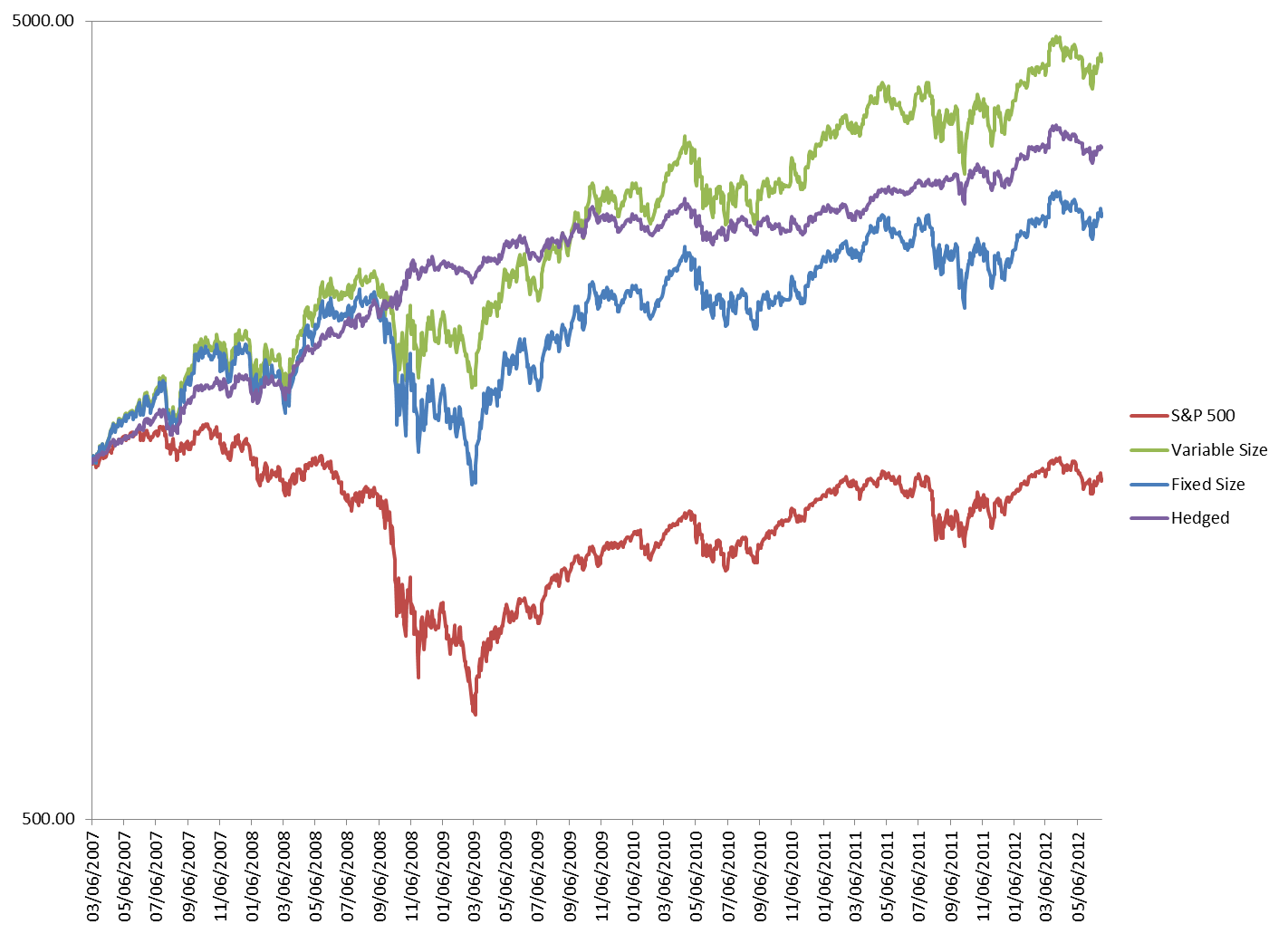

On some further analysis, a partially hedged position has a better reward/risk ratio Ė especially in bear market sector configurations:

I am cancelling my order to cover the XLK short and to buy XLF.

Right now the model has been fully hedged, but in bear market configurations a half hedge is sufficient: approximately 50% of the long positions.

Itís not EXACTLY 50%, but Iím not going to do the math this morning.

I am still planning to exchange PDLI for FCX, as long as they donít gap away from each other.

-

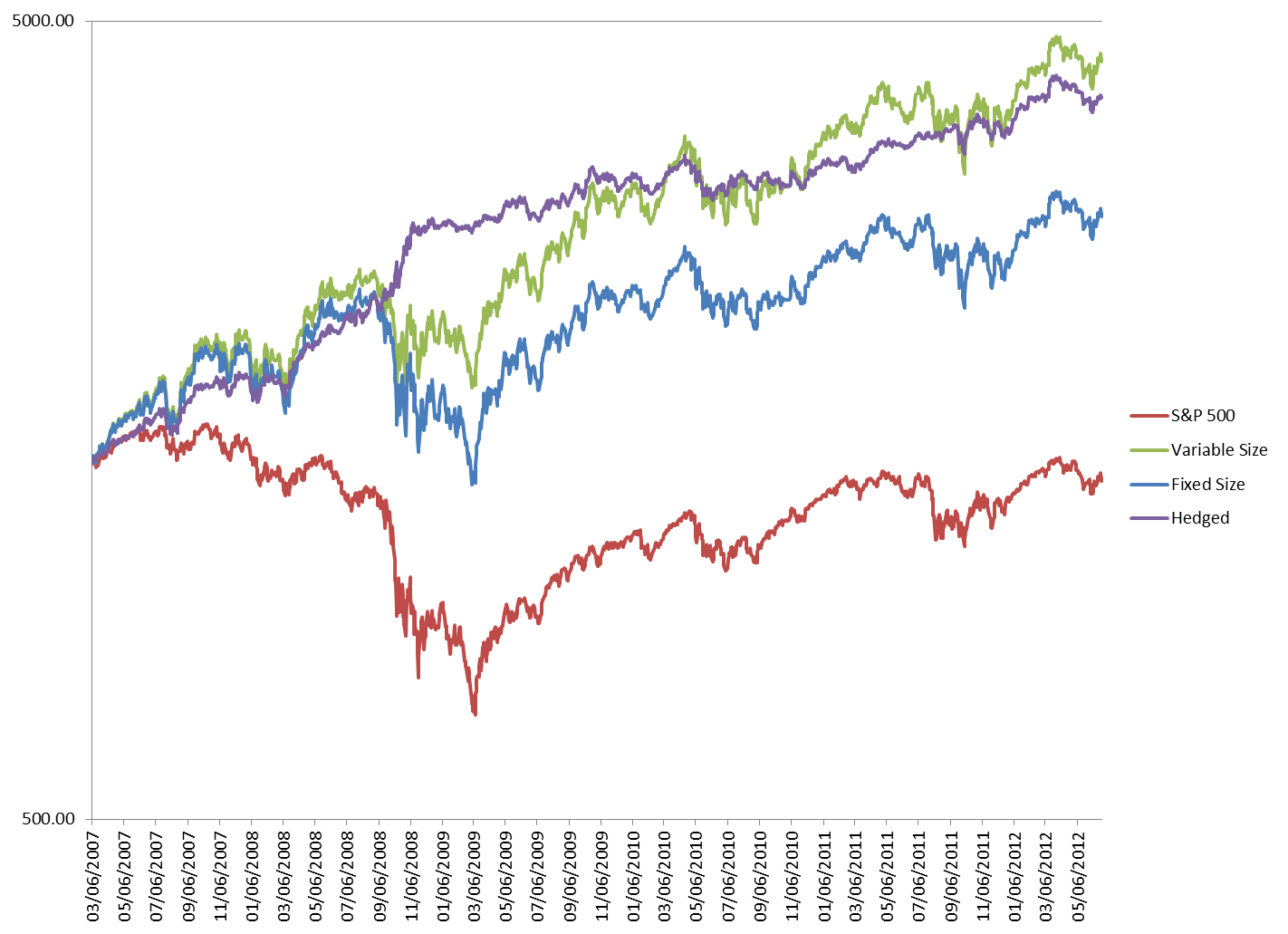

Fixed the math.

Sorry for the confusion. There was an error in my formula that was nagging me, and it took a while for me to get to the bottom of it.

Good thing, too, because I was able to fix something else I had thought of.

I'll be following the formula shown by the purple line until the sector configuration is that of a bull market. At that point I'll revert to the gold line. They both have similar long term results, but the purple is best for the faint of heart...

Currently calling for 110% long XLF and 50% short XLK.

On the full model I'll be 100% long the fundamental selections, 10% long XLF, and 50% short XLK.

-

Realtime note

Bought XLV and sold XLF at 9:58am.

-

Eh...

Back to financials.

I'll still do END OF DAY trades, but no more day trading.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote