Or one could follow the cycles......

Or one could follow the cycles......

Ernst,

I just bought the book that you have referenced. I am going on a short holiday starting on Wednesday and will read the book on the road.

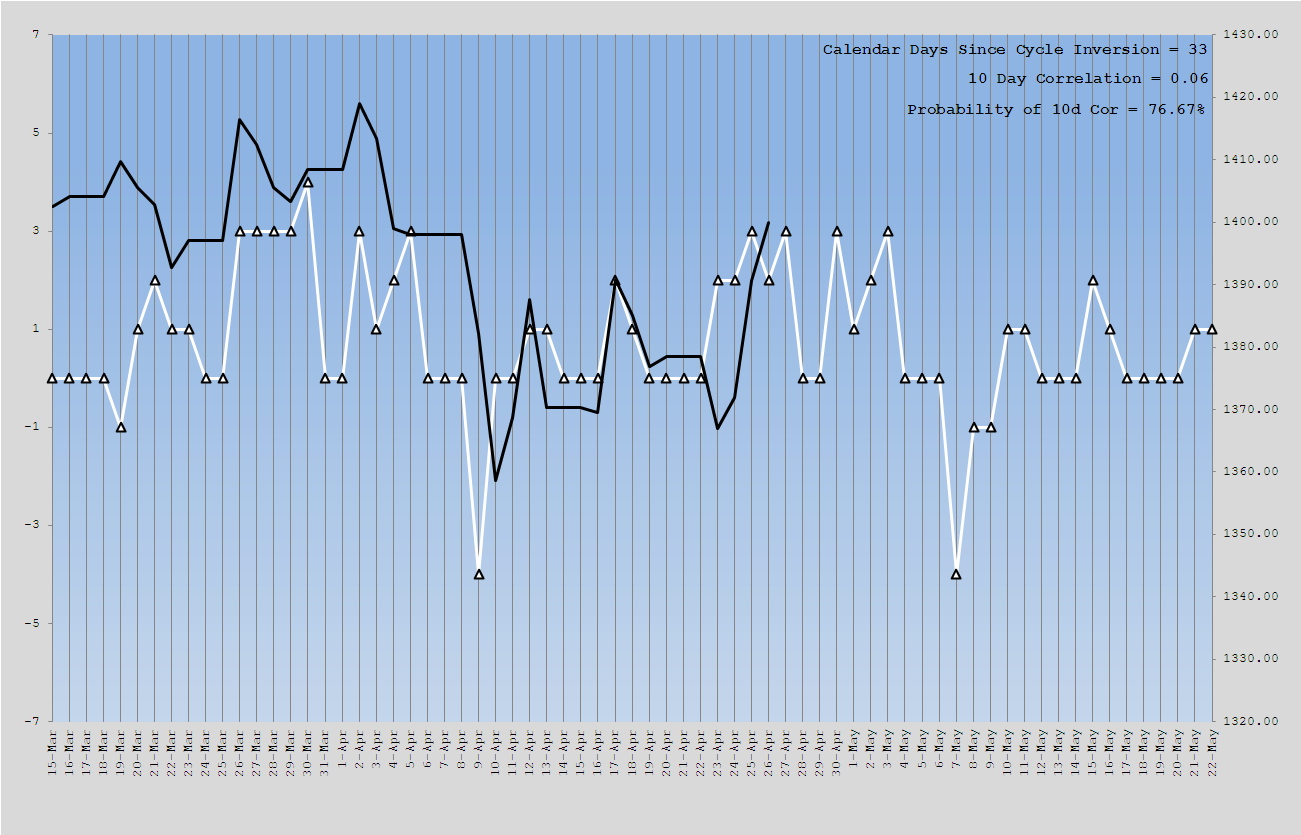

Meanwhile I have created a list of trades following my Combo-MF rules. I used TQQQ as vehicle because I believe (with the backtests that I have done) that I can rely on this trading model. The trades are these that the model should have generated from September 29, 2011 as Pascal has used this period for his ongoing "20DMF with gaps" study. For each trade I have deducted a 0.50% due to transaction and other fees that each trades has to wear.

I am looking forward to the new study from Pascal regarding the 20DMF with gaps because I believe this will further improve my model. Maybe I will not need the VSTpro model in the end...

PdP

Attachment 13997

As a simple note, I would be very careful about betting the Kelly size on any trade. Not only will a series of bad trades reduce your equity quite quickly, the intra-trade drawdown will most certainly cause you to abandon the strategy after just a few bad trades.

Many individuals, and one I know personally, use about 0.8 * Kelly size to size their positions. The gentleman I know has taken his portfolio down over 50%, and is now in process of rebuilding it back at a pretty good rate because the markets are cooperating. If you can tolerate 50% realized loss, then perhaps this is a good strategy for you.

Before any decisions are made, I would review Van K. Tharp's "Definitive Guide to Position Sizing". Pricey, but one poor trade saved by your learned knowledge from that book could pay for it quite easily.

By the way, the Turtle's method of adding 0.5% position as the equity moves up 0.5%N is quite a solid concept and one that I track with my own trading (paper, I don't trade this method).

Regards,

pgd

As Gann once said "Time makes price right"

Im sure he would have said the same about Effective Volume. Time makes volume effective.

It baffles me why most traders are so preoccupied with price.

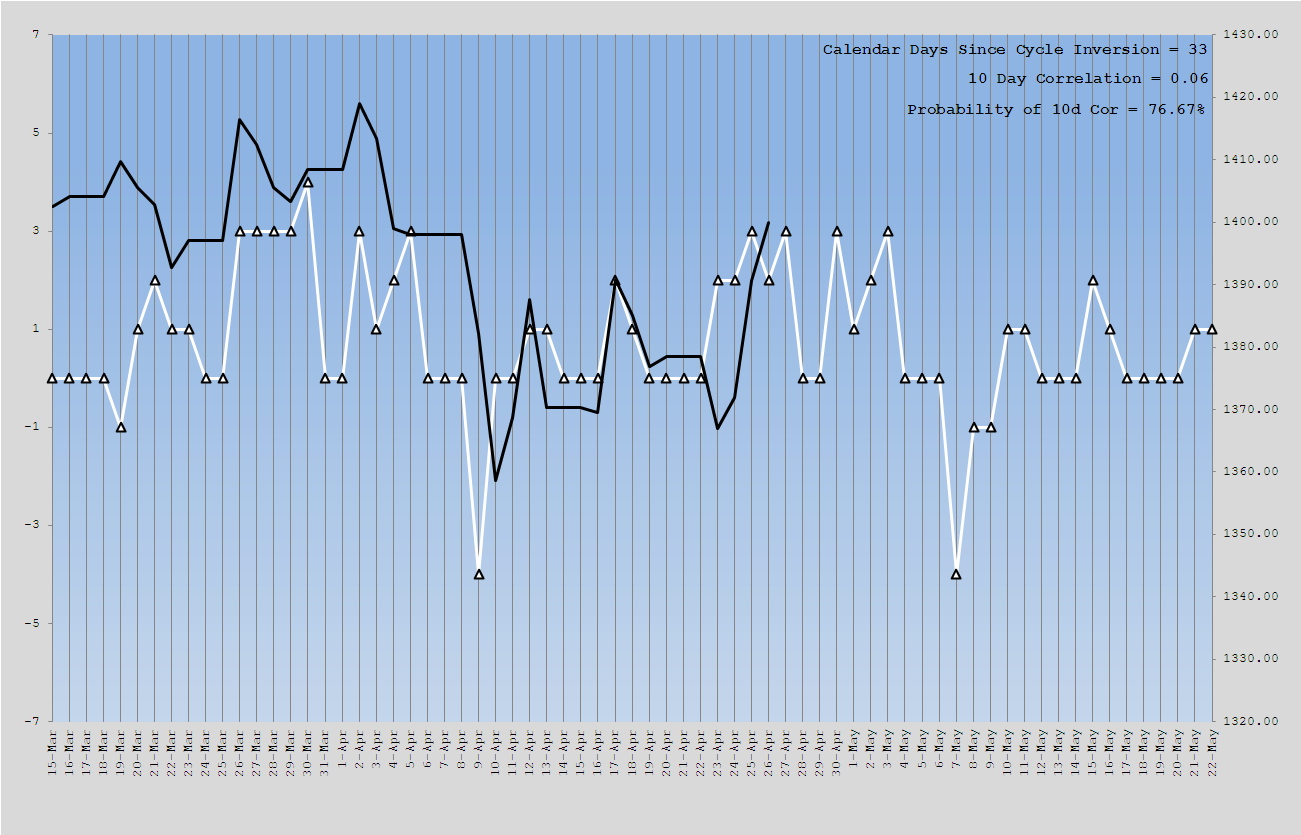

The chart i previously posted incorporates 1 of three cycle methodologies.

The cycle i included in the chart is a natural cycle, however, i also create a geometric cycle and also an astronomical cycle. Which i have not shown.

It is possible through a technique that i devised to extract these cycles in these 3 different forms and extrapolate the results into the future therefore producing the most likely points in time for swing high and lows. I trade these, nothing else, i dont even worry about price.