-

Shakeout And Reversal - January 17, 2012

In spite of negative price changes Friday for all the main indices, the 20 DMF was 18% positive for the day and all the closing prices have successfully conquered and surpassed the intraday VWAP’s. Professionals and large players’ programs were clearly buyers of the weakness.

IWM enters the shortened opex week near a very strong support confluence area (5-day VWAP =75.99, 200 dma = 75.95, WPP = 75.91 and MR1 = 75.90) which was successfully tested all of last week. Friday’s shakeout and reversal have all the characteristics of an imminent fast up move after a false down move.

With the robot looking to short at a limit price of 77.52 near weekly R1 (77.40) and daily R3 (77.59), the setup has a good chance to trigger soon. I can only repeat that, technically, it looks like a quick pullback opportunity against the trend with a limited potential below the 200-day moving average (75.95). It doesn’t deserve much leverage exposure IMHO as long as the 20 DMF stays neutral. The initial stop at 79.16 is mostly protected by Monthly R2 (78.05) which has a 66% probability of marking the highs for January.

The GDX MF remains in a buy mode, but the robot could not find any edge for a new secondary entry today. Last week’s main resistance was quarterly pivot (54.78) and we’d like to finally see a close above that level to further improve the technical progress of the initial position.

Billy

-

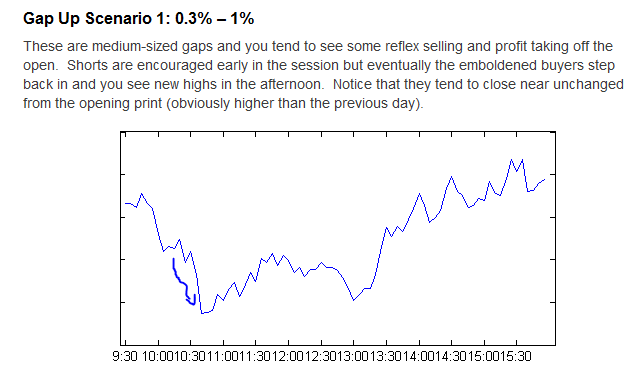

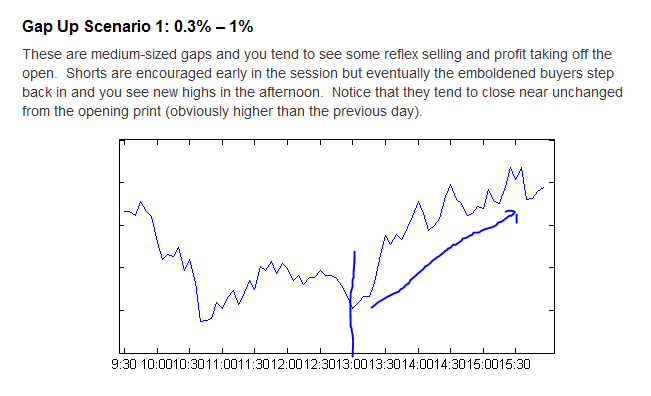

a gap up day

It will be interesting to see if the following pattern holds yet again:

-

now is the time

Again, the interest is quasi-scientific (TA) and personal.

-

That must be last week's algo....

I tried it with gdx more than a few times today, but you know what they say... never try to catch a falling knife, and I'm a bit cut up. Now wouldn't it turn my brown eyes blue if MF were to turn around and roar up in this last minute....

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote