No Comment...

No Comment...

Last edited by Billy; 06-07-2011 at 02:43 AM.

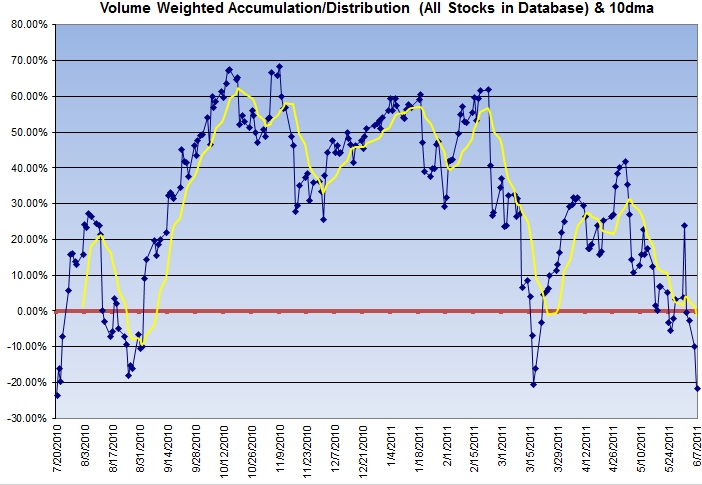

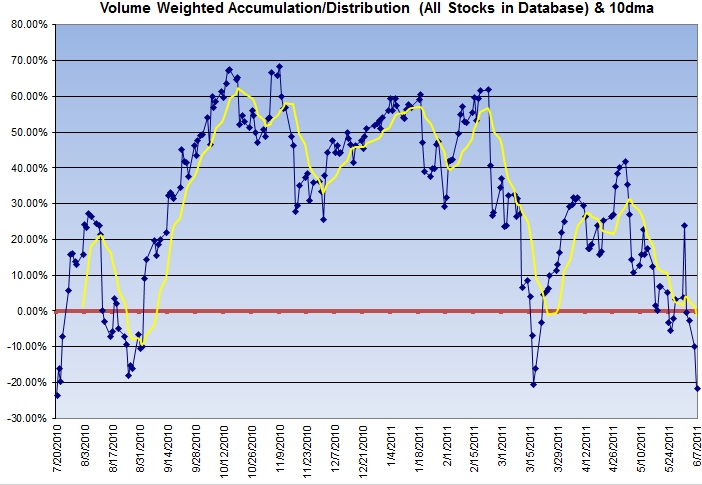

OK. Thanks. SO we can say that since the POMO market began in March 2009, -20% was a place for a reversal, except for the HFT triggered flash crash in May.

If we break this level here, then we might be in for something stronger on teh downside.

However, As you wrote yourself some weeks ago, POMO money is staill available and might amplify any technical bounce that is hsaping up in the futures" market.

Pascal

I notice that POMO used to have only buy operations, now they have sale operations too.

If purchase operations pumps liquidity into market, causing market to edge up, does the sales operations mean withdrawing liquidity from the market and cause market to edge down?

Today is a sales operations day.

Here's the link

http://www.newyorkfed.org/markets/to..._schedule.html

The ongoing POMO program is called “Operation Twist”. The FED is purchasing shorter-dated bonds ( 1,2,3 years) and selling the longer dated (20-30 years) variety. This is depressing interest rates and yields, making riskier asset classes (equity) more attractive. Cost of margin interest is also lower and that’s about the only sure long lasting effect on liquidity. The calendar effect of purchases and sales has mostly an intraday and ultra short term liquidity effect.

Billy