Let’s start with GDX where the cluster structure confirms the weak (neutral) long signal from the GDX Robot. The first resistance cluster is extremely strong at 28 and begins with the Weekly Pivot (56.94) up to Quarterly Pivot (58.19). Two of the strongest resistance levels are included, the 200 dma (57.71) and the Semester Pivot (57.63). The end-of May attempt of breaking above QPP - and the same strong cluster- failed and one can observe how quickly the decline accelerated once SPP was crossed to the downside. This is typical of organized distribution by large players and the vicinity of the 200 dma suggests that they were institutional players rather than market makers. Since there are only daily levels (not shown) just below Friday’s close, these are most likely to plan for re-accumulation for their own accounts around Yearly Pivot (55.19) which is clustering with WS1 (55.37). Hence their long targets will be the next weekly resistances levels: WPP (56.94), then WR1 (58.09) near the highs of the cluster. Watch for early rejection with volume at SPP (57.63) for the first hints that institutions are launching a new sell program. Once above that powerful cluster, the sky is blue with strong support and very weak resistance.

The optimal buy point for a new entry is at 55.82 and downside risk will be limited by the floor WS1 (55.37) and YPP (55.19) supports. The most probable 3-day target from such an entry is at 57.33, just under the infamous Semester pivot. Notice how the trailing stop for the existing robot long position (54.34) is ideally placed, just below QPP (54.37) and just above the initial entry price (54.31).

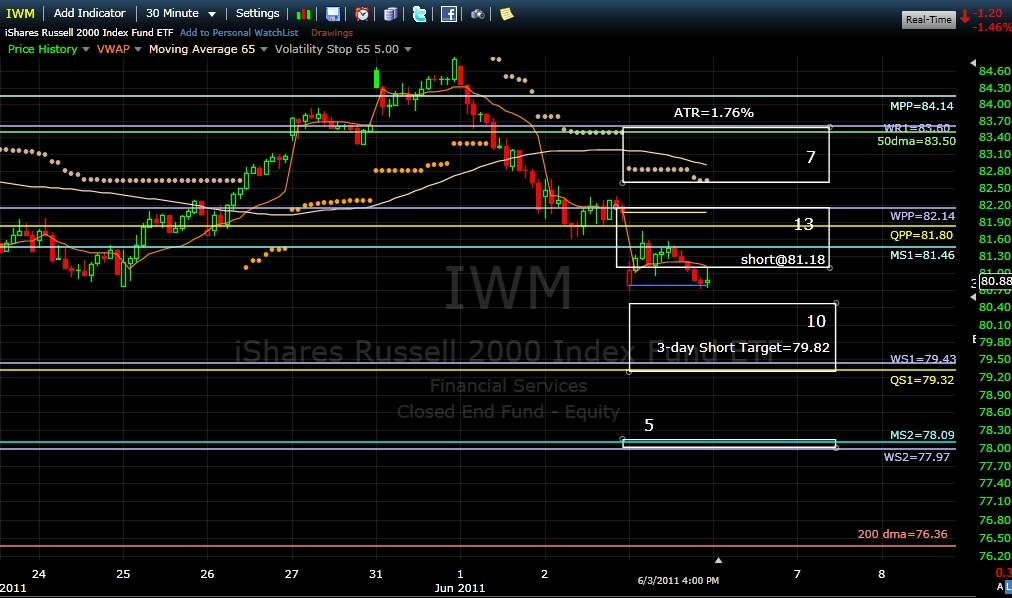

For IWM, the path of least resistance is still to the downside. Here too, there are only daily floor levels (not shown) before the bottom of the first support cluster around Weekly S1 (79.43) and Quarterly S1 (79.32). Market makers have no vested interest currently to accumulate new long positions or cover short positions above that area, so any bounce into the first stronger resistance cluster can logically be shorted. The new short entry price of 81.18 is close enough to have a chance to be hit early on Monday just before strong resistance will appear at Monthly S1 (81.46) and Quarterly Pivot (81.80). In fact, from a standalone multi-pivots perspective, a new short entry will be safe as long as Monday’s close is below Weekly Pivot (82.14). And the robot statistics and probabilities give us a most probable 3-day short target of 79.82 just above the next potential consolidation area (WS1 and QS1). A further breakdown below QS1 (79.32) will find only very weak support around Monthly S2 (78.09) and Weekly S2 (77.97) and the 200 dma (76.36) will most likely become the next support and potential bottom area for this correction.

As a side note, IWM closed for the first time in a “Strong Decline” daily stage since the summer of 2010, which is pointing to a capitulation selling wave soon.

Billy

Reply With Quote

Reply With Quote