-

oops

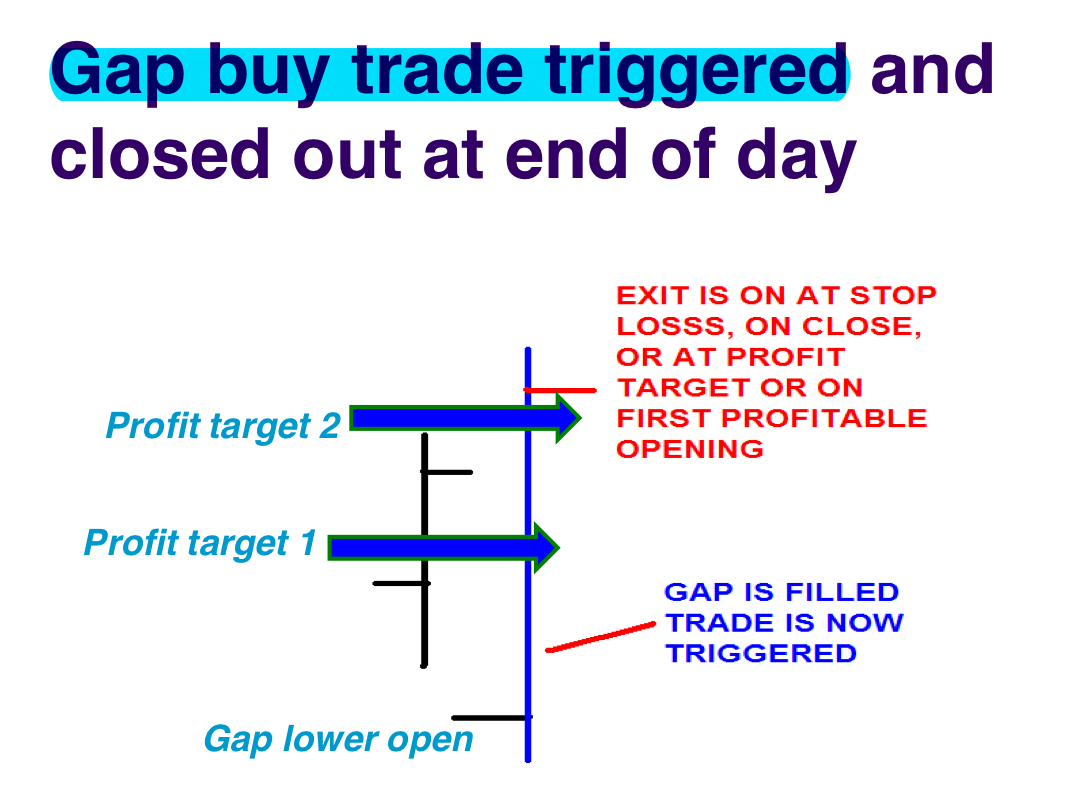

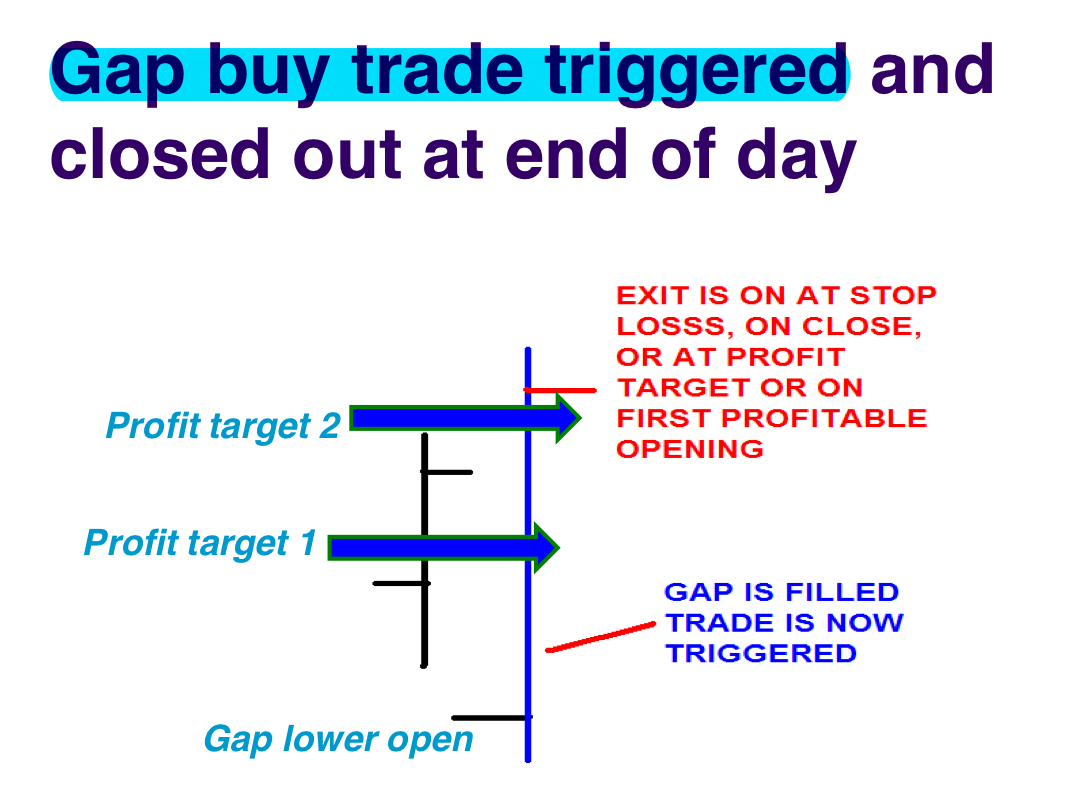

Yesterday and today qualify as Larry William's OOps pattern for ES rth / SP500.

I did a count on that pattern ~two months back and found it not to be stellar and only a small sample size.

Maybe it is more common on single stocks.

Anyway - today it worked.

(I can't find my notes right now, so can not share the numbers)

-

Peter,

I have a hard time to understand what you want to say.

Can you explain where the opportunity is? Maybe to late already?

Pascal

-

Sorry for the cryptic post.

This is a 2-bar trading pattern (Daily bars) that was shared by Larry Williams in his books and courses.

The entry was yesterday at the moment the Gap closed (low of bar not the bigger gap to the close of yesterday).

(I shamelessly post after the event)

One exit is to hold overnight till the open.

The concept is that buyers (defined by a up-day) overreact at the open caused by the gap down.

If the mkt is able to close the gap it shows a form of shakeout action.

And retail sellers enter shorts based on the gap - they are trapped at gap close.

Please see the attached excerpt from Larry's book "Longterm secrets to shortterm trading" about the pattern.

oops.pdf

The scope of the pattern is done within one day.

Again better test it against current environment and for your market traded.

I simply noticed yesterday, that the pattern developed as he described it,

and now - with hindsight - it worked as written..

Peter

-

Thank you Peter.

This is now much clearer.

Pascal

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote