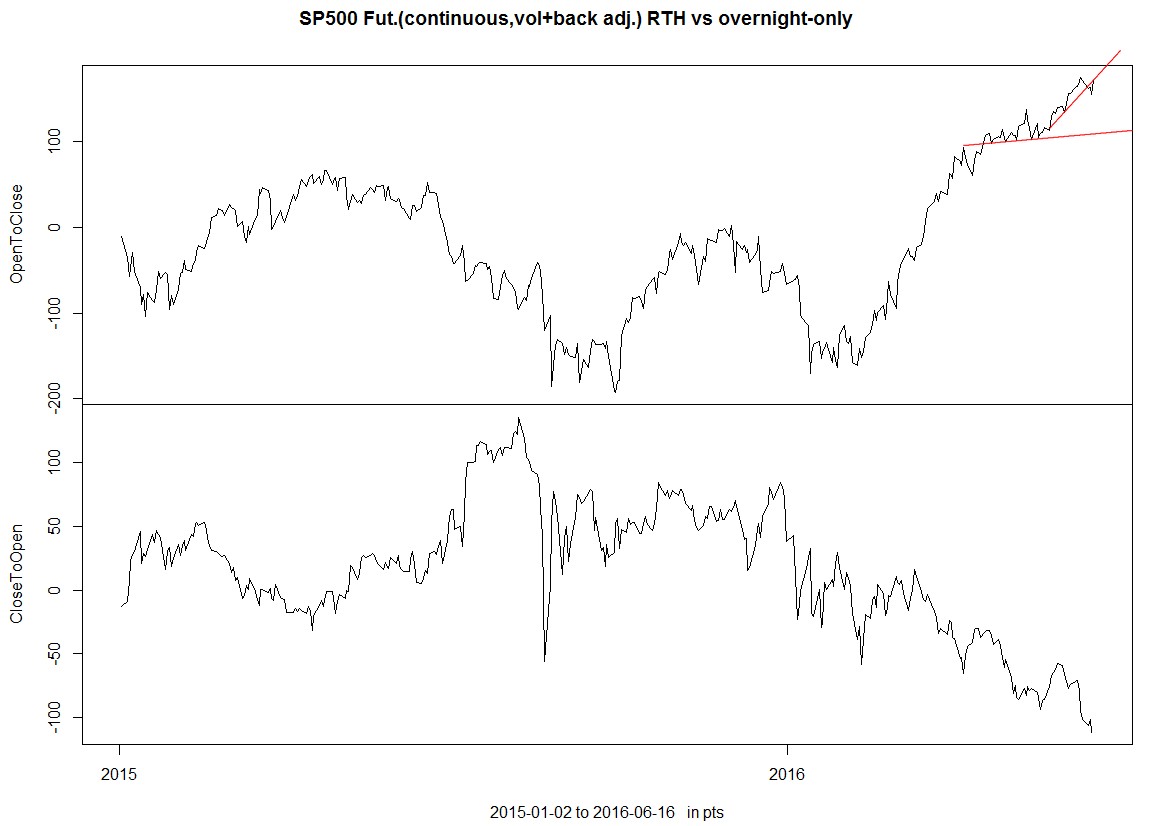

strong RTH buying again,

after weakness in Asia and Europe

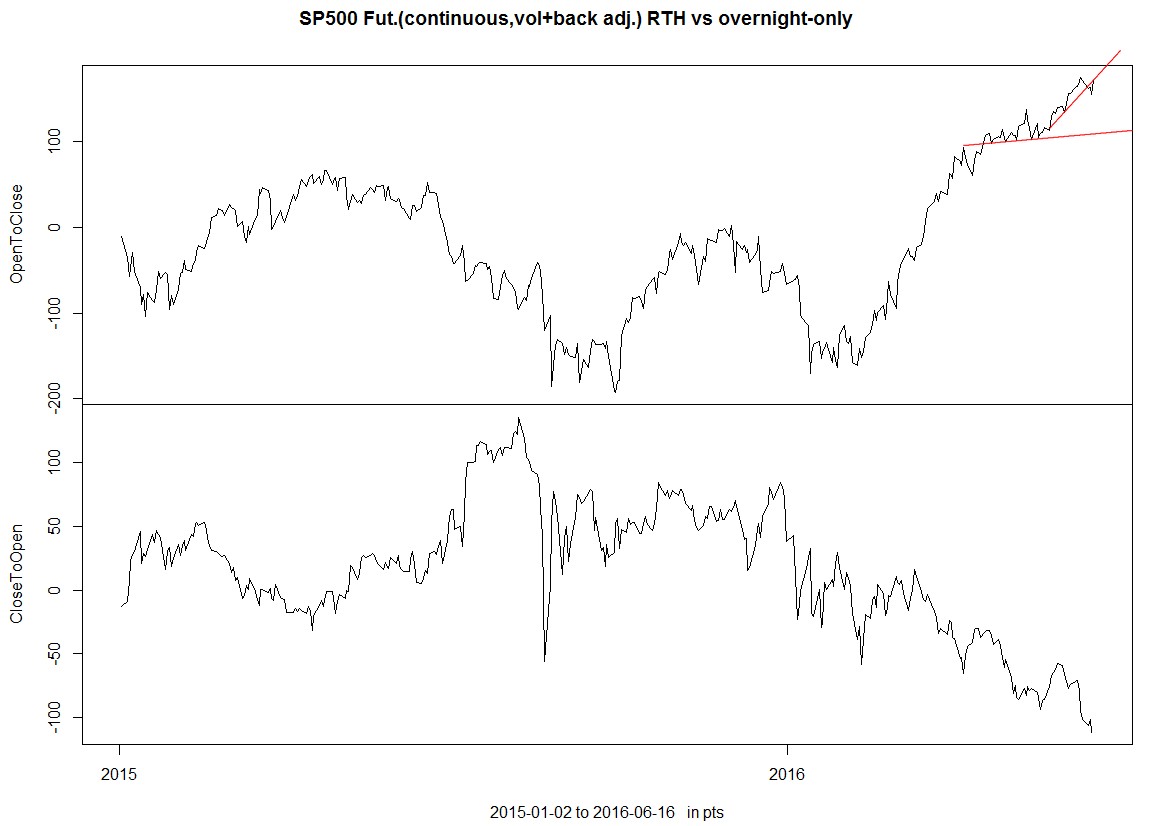

strong RTH buying again,

after weakness in Asia and Europe

Thanks for the update

pascal

a trend line break

TY Pascal,

The phases you spotted are interesting.

Here are the dates to your trend line breaks.

(It is a bit subjective)

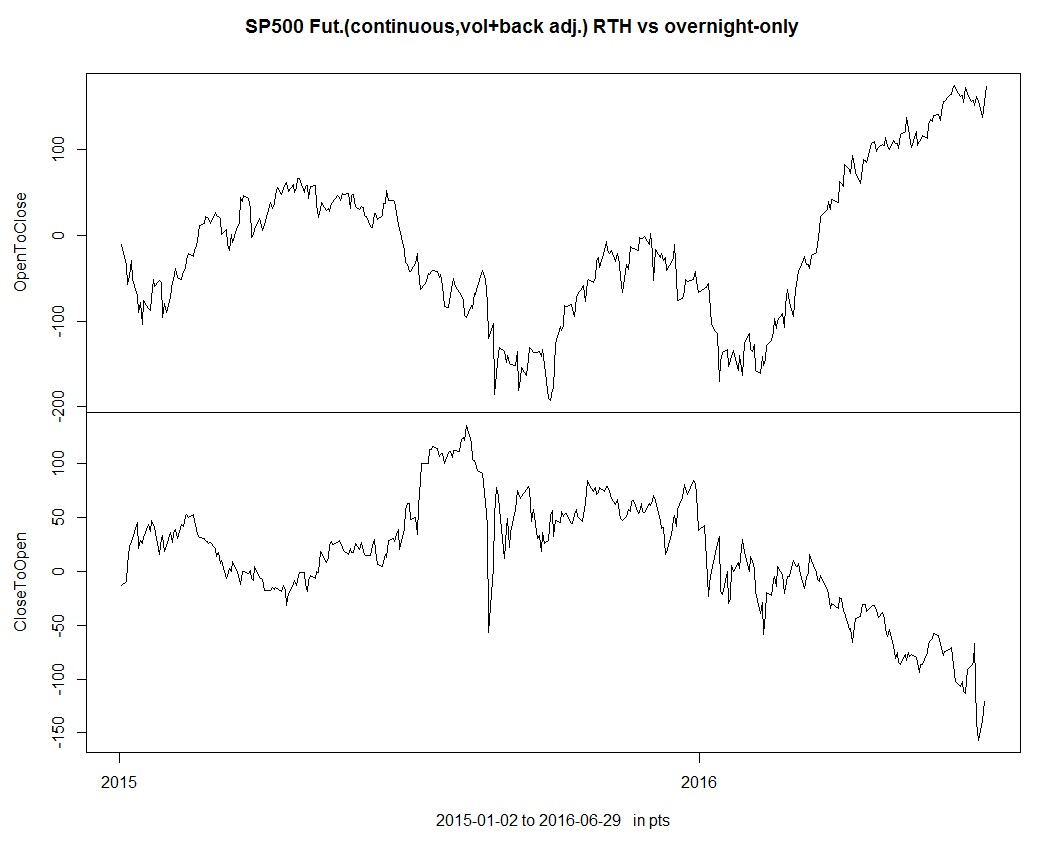

RTH-Buying vs the normal eth time series of the ES futures:

here are the percent returns for the selected dates:

(I hope I have no error in the steps)

here are the means of the above:

I have not adjusted for a buy&hold base line.

And 2x 2 signals overlap.

But I think a trend line break is not a strong enough signal for a short.

Maybe for T+1, but this is more like a momentum play

(going with a breakout for a day).

Last edited by PeterR; 05-23-2016 at 06:08 AM.

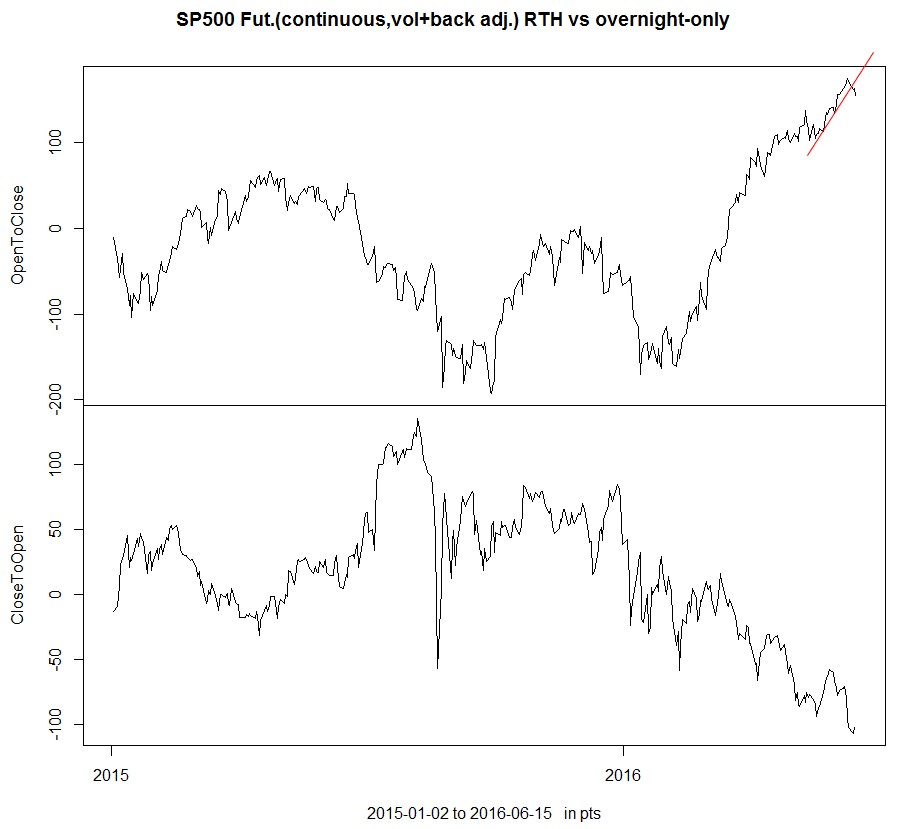

no TLB in today's nearly unchanged RTH session.

But I looked into the asia- and EU-session separately:

Overnight in asia is mostly flat since start of the year.

Overnight during Europe session is mostly negative.

Conclusions:

1.

If one plans to go long SP500 futures, look for a potential pullback during the EU-session

2.

This is not clearly visible in the charts,

but multiple times in the last days a measured move target (based on some RTH move) was hit during the asia session - and afterwards we got the EU-pullback.

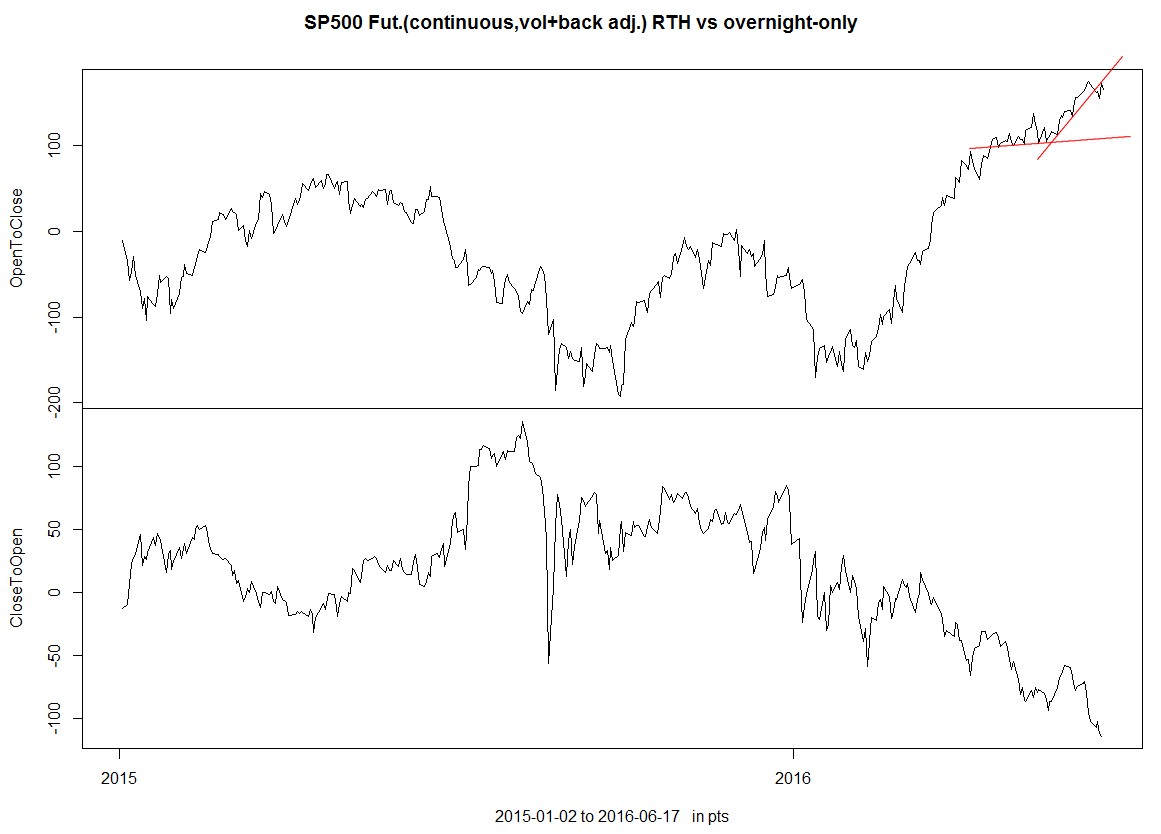

We had some selling rth.

Probably tested the steeper trend line from below.

I don't know how much weight we should give to the daily developments.

IMO key is to spot a change in the general behavior of buying during RTH but selling ON.

This would be a hint that some key players change their behavior for a while.

Pascal identified the NIRP-refugees as a likely dominant group.

I would add pension funds within the US doing something similar to NIRP-refugees: hunting for yield in US equities - or stop doing so for a while.

Aswath Damodaran gives us some equity yield numbers (Implied EquityRiskPremium):

Implied ERP on June 1, 2016=5.03% (Trailing 12 month, with adjusted payout), 6.12% (Trailing 12 month cash yield); 6.16% (Average CF yield last 10 years); 5.54% (Net cash yield); 4.66% (Normalized Earnings & Payout)

Last edited by PeterR; 06-18-2016 at 01:48 PM.

A 2th buying RTH session.

The Brexit event is nearly invisible now.

Thanks Peter.

Keep us posted on this evolution.

Pascal

Yes, indeed... What a strange market!!!

Pascal