-

Secondary Offerings

As part of a new book that I am writing, I will discuss how to trade stocks linked calendar events, such as Earnings dates, IPOs, Secondary offering and Insiders unlocking dates.

These events are interesting, because they offer very specific trading opportunities that are independent of the general liquidity driven market.

One example is BCRX.

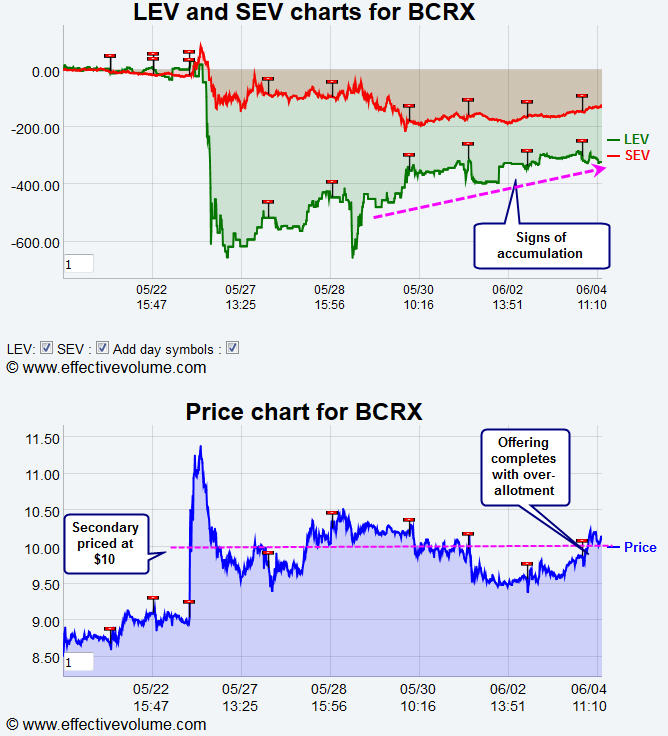

BCRX is a biotech company. Before the close of May 27, the company announced positive results of one of its drug trials. The share price opened at $11, but subsequently pulled-back down to $10. The offer was priced at $10. $100,000,000 of new shares imply a dilution of about 16.7%.

I bought the stock several times whenever it pulled below $10 on an positive EV pattern. We can see that once the deal was closed, the stock easily cleared $10.

I will start a new "Secondary Offerings" sub-section within the short term stock selection section.

This new section is not open yet, but I intend to open it in the next few days.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote