-

Anomaly: lower GDP and lower unemployment

Hi Pascal,

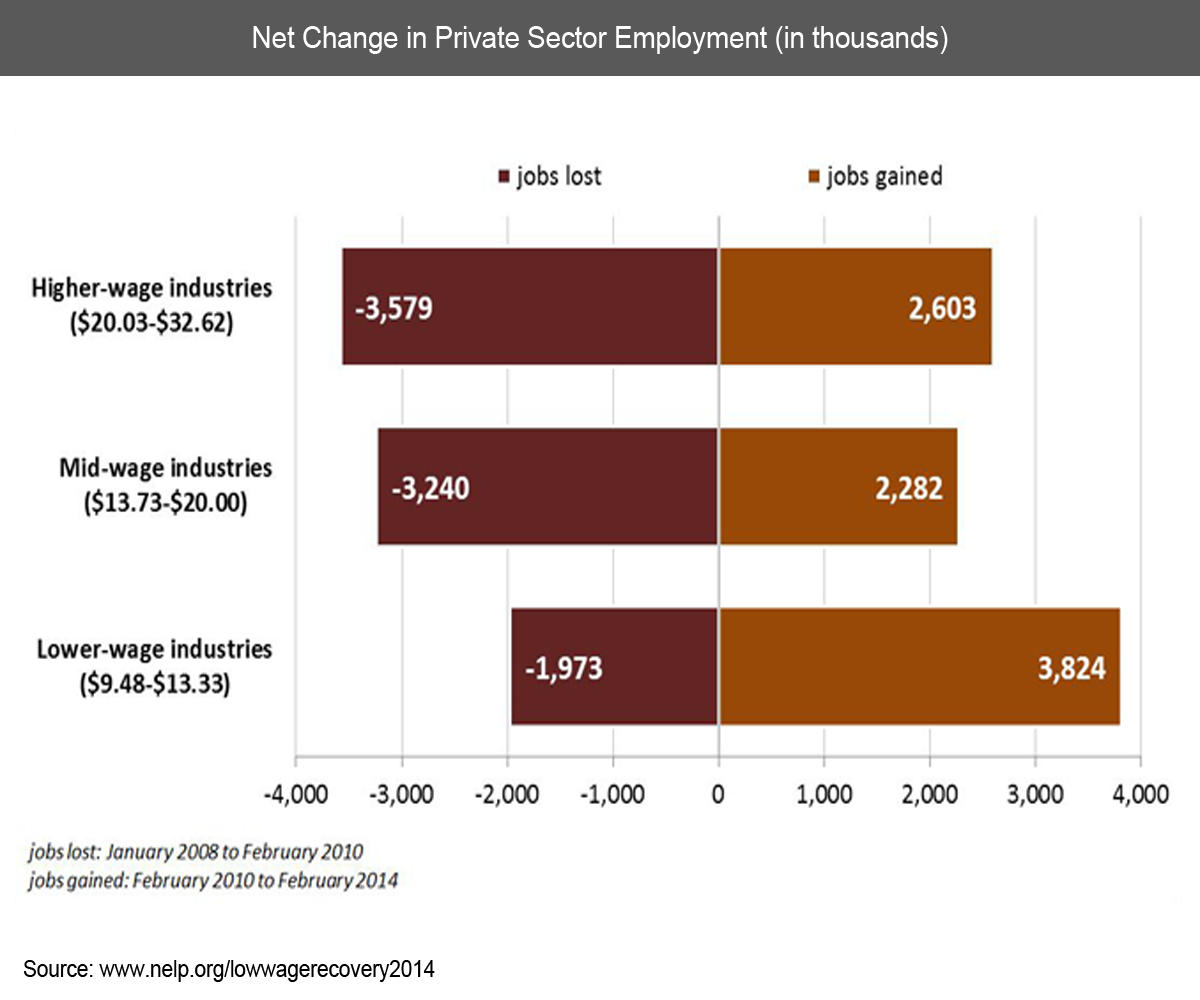

In your recent market comments you stated: "It is interesting to see GDP decreasing together with unemployment. It is as if more people were needed to produce less. Is this a good example of productivity, which is the basis of a capitalist economy?"

Answer: No, it's a good example of the lack of contribution to GDP that we can expect to see from low-paying service-sector jobs that are the major contributor to recent job growth in the U.S. See attached graphic.

Cheers,

Neil

-

And of course this exacerbates the problems of wealth inequality and income inequality. Not good for anyone, including those with the most wealth and income.

\n

-

Thanks Neill. This is interesting data.

When you look at your data, keeping and average wage for each bracket and calculate the total wages $ lost per Month, you arrive to 3.5 B$/Month of wages that employers did not have to pay. That is basically "cost reduction".

Compared to QE, the scale is still low, but this money goes right in the profit line.

Pascal

-

Until it comes time to buy the company product and guess what? Consumers don't have the money because their income has been cut.

-

Not really: you need to provide more state help to those who need it.

Easier access to student loans, car loans, health care loans, etc. As far as these are taxpayer guaranteed, there will be willing lenders.

I wonder whether there has been an inventory build ups on high-tickets consumer goods.

Pascal

-

In the U.S. we have a bizarre situation: One can work two or three jobs and still not make a living wage. Meanwhile, highly profitable corporations (think WalMart, McD) underpay their workers and advise them to apply for public assistance to make up the difference. In effect, taxpayers are subsidizing the labor costs of these companies that really deserve no subsidy. Sorry if my comment is off-topic, but there will be a price to pay (so to speak) down the road, one way or another.

Neil

-

I think that if it weren't for fracking (harmful in the long run) and increases in health care spending (Obamacare) we would have negative GDP.

I read somewhere that CLOs are making a comeback, so maybe soon we'll be getting collateralized refrigerator and washing machine loan obligations put together by financial entities that borrowed the money to do so at rock bottom interest rates and at high multiples of leverage and that then sold these CLOs to pension funds. YAY!

Neil, I meet the folks that you describe every day. I talk to them. I hear their stories. If you're not in North Dakota making >100 an hour drilling then you're in the camp that you're talking about. I'm in the Hudson Valley, and it's exactly as you say.

And speaking of car loans, we had an old Subaru for sale, and some guy in a flashy new car stopped by because he couldn't afford the car payment any more and he said it was going to be repossessed, but he couldn't afford the 4k we were asking. Instead, we sold it to a recent immigrant to the US whose brother is a top economics professor in his country, and he said his brother thinks there's going to be another day of reckoning (soon? maybe, maybe not) and that the safest place to be would be the United States.

A sample size of one does not tell the tale, but this is what I see with my eyes. New York City, my home town, is a little different, but underneath the surface there's some of the same stuff happening there too.

One of the talking heads says that during the next crisis the U.S. won't be able to be the lender of last resort any more because it's all tapped out and that SDRs will be the new backstop.

The world really needs some good ideas.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote