-

09/22/2013 Mousetrap

Sector Model XLU & XLK 1.54%

Style Model Small Value

Large Portfolio Date Return Days

ABX 4/11/2013 -22.91% 163

TTM 5/6/2013 1.17% 138

OKE 6/17/2013 20.67% 96

BTI 7/1/2013 5.84% 82

CLH 7/8/2013 10.47% 75

FAST 7/22/2013 7.73% 61

VAR 8/2/2013 3.96% 50

OUTR 8/19/2013 -25.95% 33

QCOM 9/3/2013 4.19% 18

FLR 9/16/2013 7.14% 5

(Since 5/31/2011)

S&P Annualized 10.94%

Sector Model Annualized 23.11%

Large Portfolio Annualized 28.53%

From: http://market-mousetrap.blogspot.com...arket-but.html

Rotation: selling FAST; buying CXW.

Rather bizarre rotation – selling a building supply company and buying a REIT. No clue what that means, but I’ll follow the model. CXW has basically gone nowhere in forever. If we’re headed toward some kind of market decline, that may not be such a bad thing…

No market comment today, though. Too many external variables to get any meaningful read on market internals.

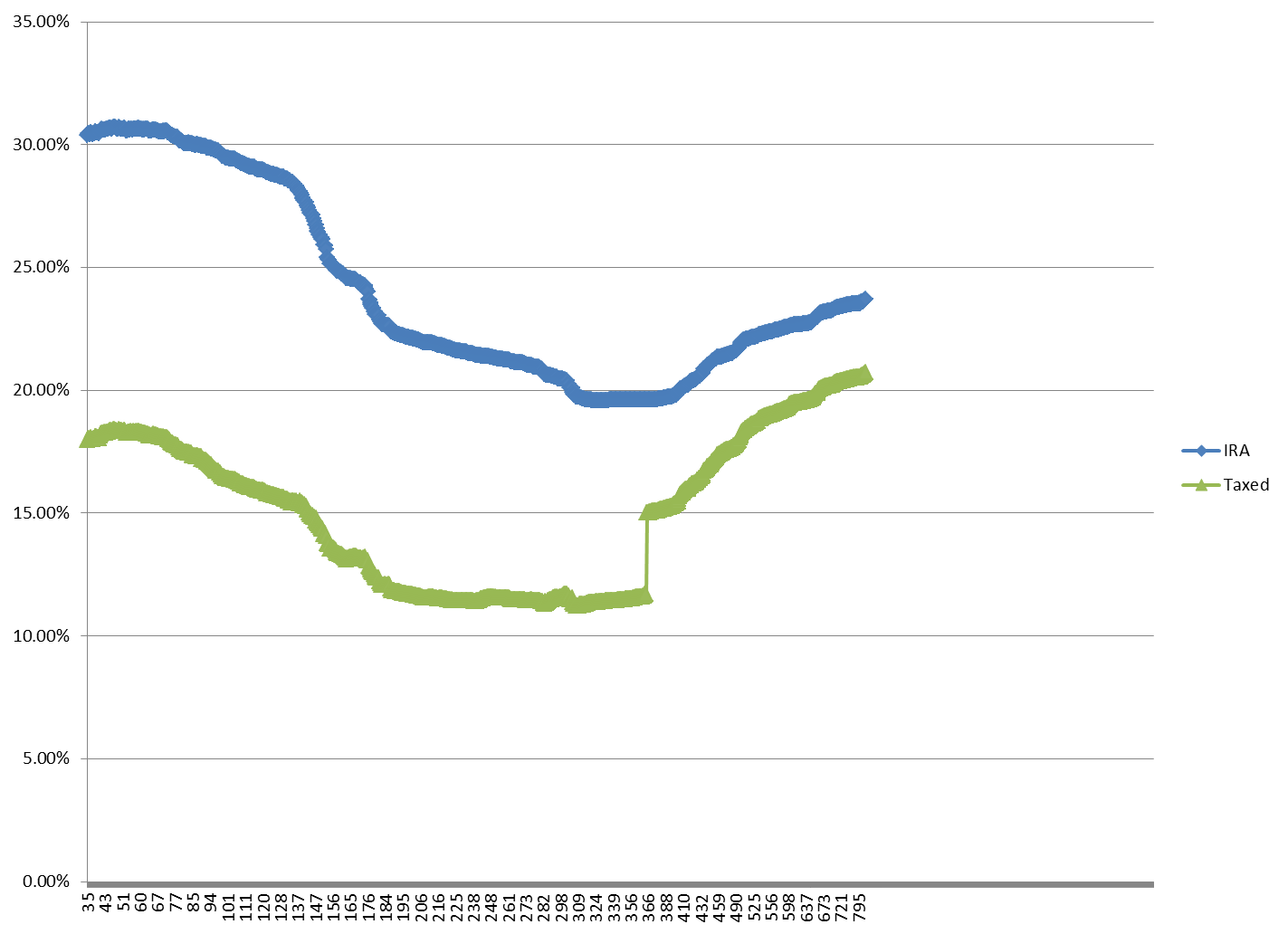

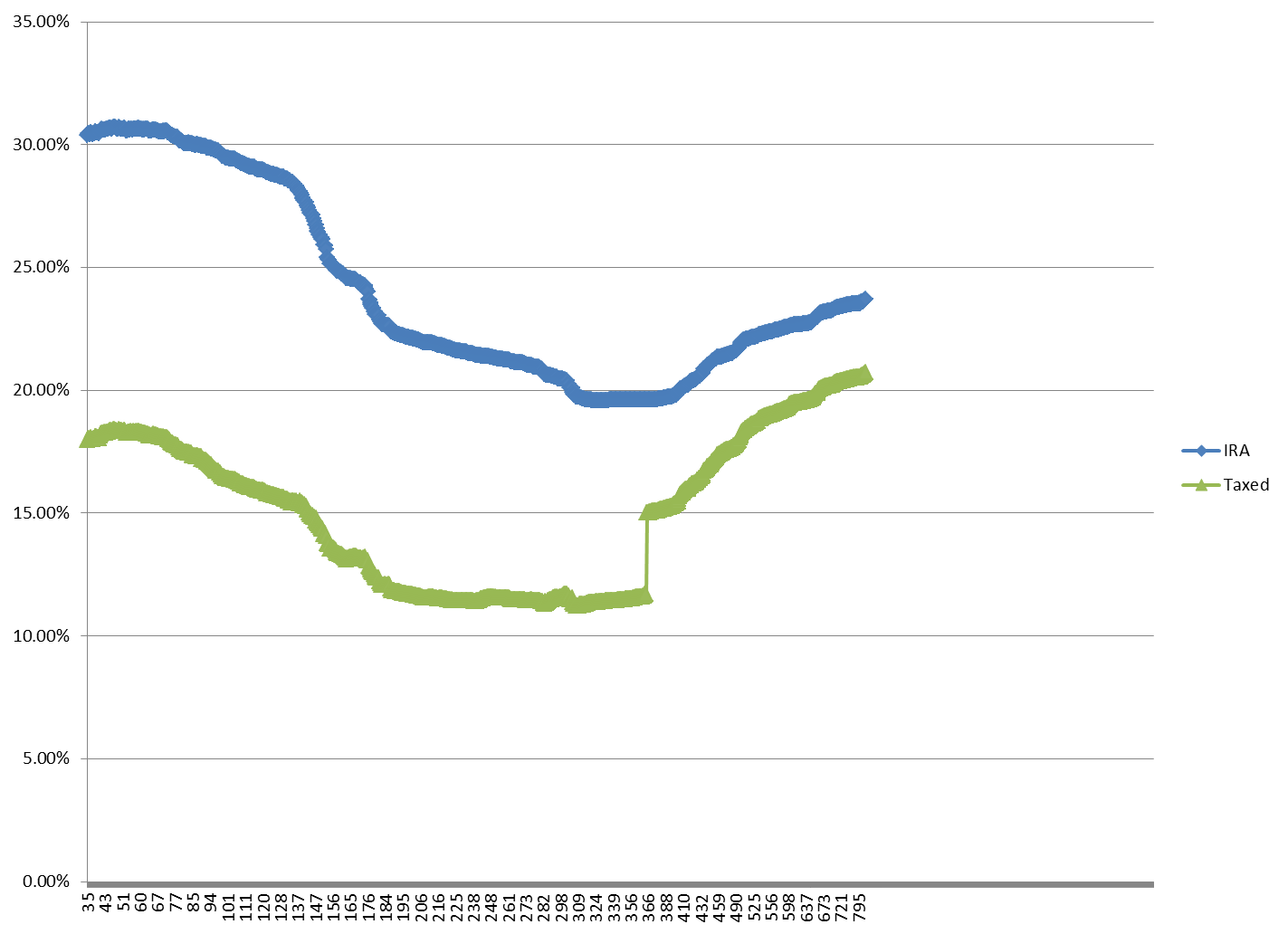

Taper, no taper, shut down, no shut down, war, no war. Eh. Can’t control it. What I CAN control is the methodology of my model. The data is continuing to mature, and the model is definitely developing into two sets: one for an IRA account and one for a Taxable account:

A taxable account clearly performs better for longer term holding periods, but I do not yet have a rotation point. I’m quite intrigued by the resilience of the selections well past two years from their original trade. The spike at one year, of course, is the difference between long and short term capital gains taxes.

Lesson for now: track your trades – when you open them, when you close them… and AFTER you close them to see how they would have done on a longer hold. You might discover something useful, as I am here.

Tim

-

Reset

Sector Model XLU & XLK 2.33%

Style Model Small Value

Large Portfolio Date Return Days

ABX 4/11/2013 -23.99% 166

TTM 5/6/2013 1.21% 141

OKE 6/17/2013 21.65% 99

BTI 7/1/2013 5.83% 85

CLH 7/8/2013 10.22% 78

FAST 7/22/2013 6.94% 64

VAR 8/2/2013 4.19% 53

OUTR 8/19/2013 -23.61% 36

QCOM 9/3/2013 4.07% 21

FLR 9/16/2013 5.52% 8

(Since 5/31/2011)

S&P Annualized 10.67%

Sector Model Annualized 23.31%

Large Portfolio Annualized 28.39%

From: http://market-mousetrap.blogspot.com...uying-gco.html

Rotation: selling OKE; buying GCO.

As I noted on the blog yesterday, the negative gap in FAST prevented the scheduled rotation. After recalculating last night, FAST moved out of the sell window.

I actually like this rotation better.

Tim

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote