-

05/05/2013 Mousetrap

Sector Model XLB 2.05%

Large Portfolio Date Return Days

BBRY 7/16/2012 115.59% 292

SEAC 9/25/2012 34.27% 221

CAJ 9/25/2012 4.01% 221

BOKF 2/4/2013 13.33% 89

SWM 2/12/2013 12.85% 81

MWW 4/11/2013 9.60% 23

ABX 4/11/2013 -18.23% 23

TPX 4/22/2013 0.35% 12

NYCB 4/24/2013 -0.08% 10

OKE 5/2/2013 -1.61% 2

S&P Annualized 9.93%

Sector Model Annualized 25.48%

Large Portfolio Annualized 33.13%

***Annualized numbers are from the date the model was launched: 5/31/2011.

From: http://market-mousetrap.blogspot.com...r-of-time.html

Rotation: selling OKE; buying TTM.

I know, I know… yo-yo trading between those two.

The model continues to struggle with the most recent picks, and I had the opportunity to do a thorough review of the fundamental selection parameters on Thursday (between numerous spit ups from a sick baby I was taking care of…).

I was able to find an error. When I corrected it I found an even bigger error. When I corrected THAT I ended up with about the same results I had started with. Turns out the first error was correcting the second one. Two wrongs DO make a right on occasion.

I was also able to measure the sector model against fixed holding periods, and hypothetical selections from the model as if they were held for 18 months instead of rotated on schedule.

What I found was that the original Greenblatt filter did better than the Graham filter, and the Graham filter did better than my Adaptive filter – IF held for 18 months instead of rotated. My model is progressively improving its short term performance by picking short term stocks.

In other words, these stocks shouldn’t be held long term.

Right now I have the rotation periods and fundamental selections set to continually evolve. But that evolution is close to breaking apart into two models. I’ve talked about this before, but it’s worth reviewing:

The goal is not to GET the most profit.

The goal is to KEEP the most profit – after taxes.

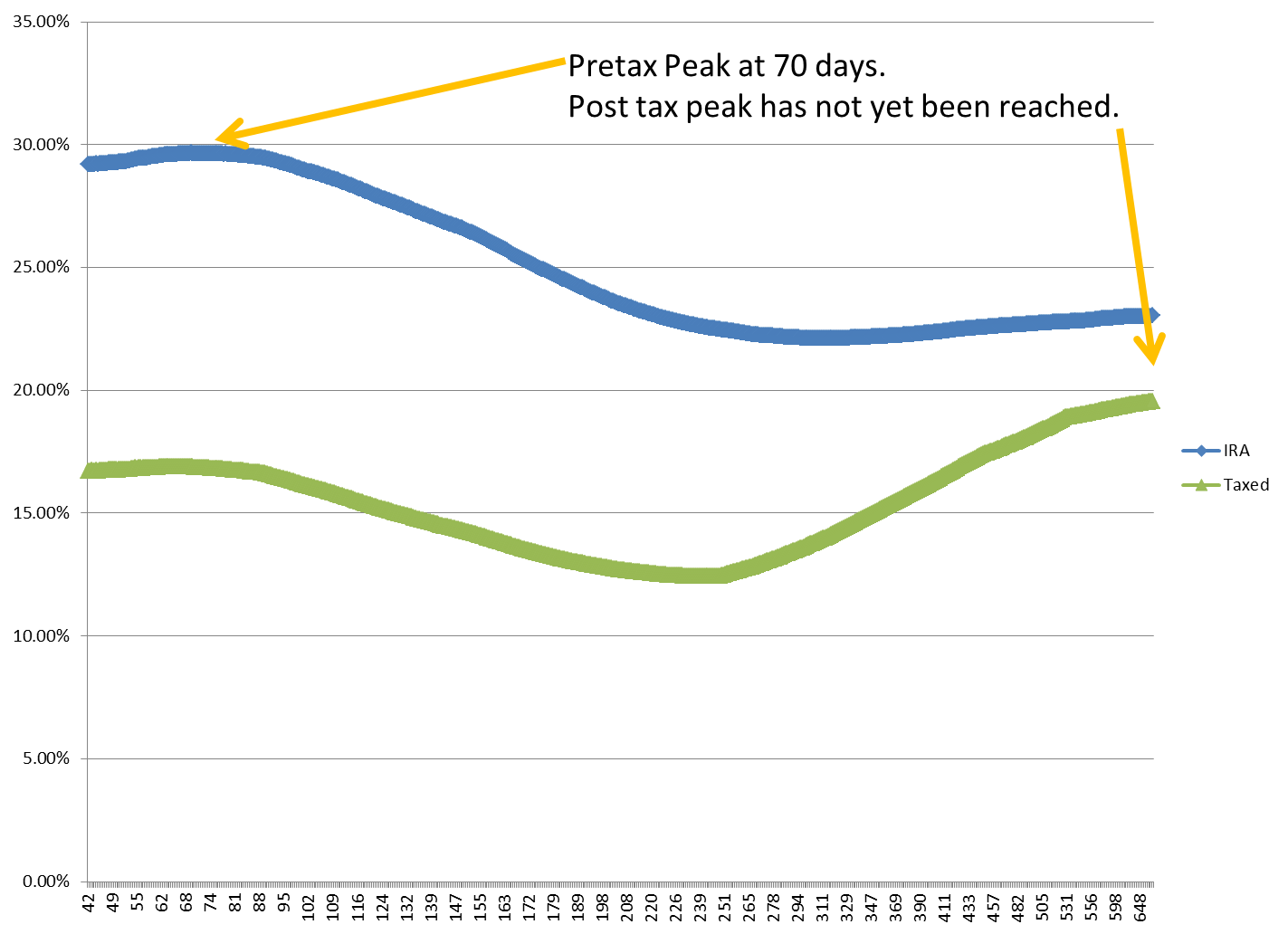

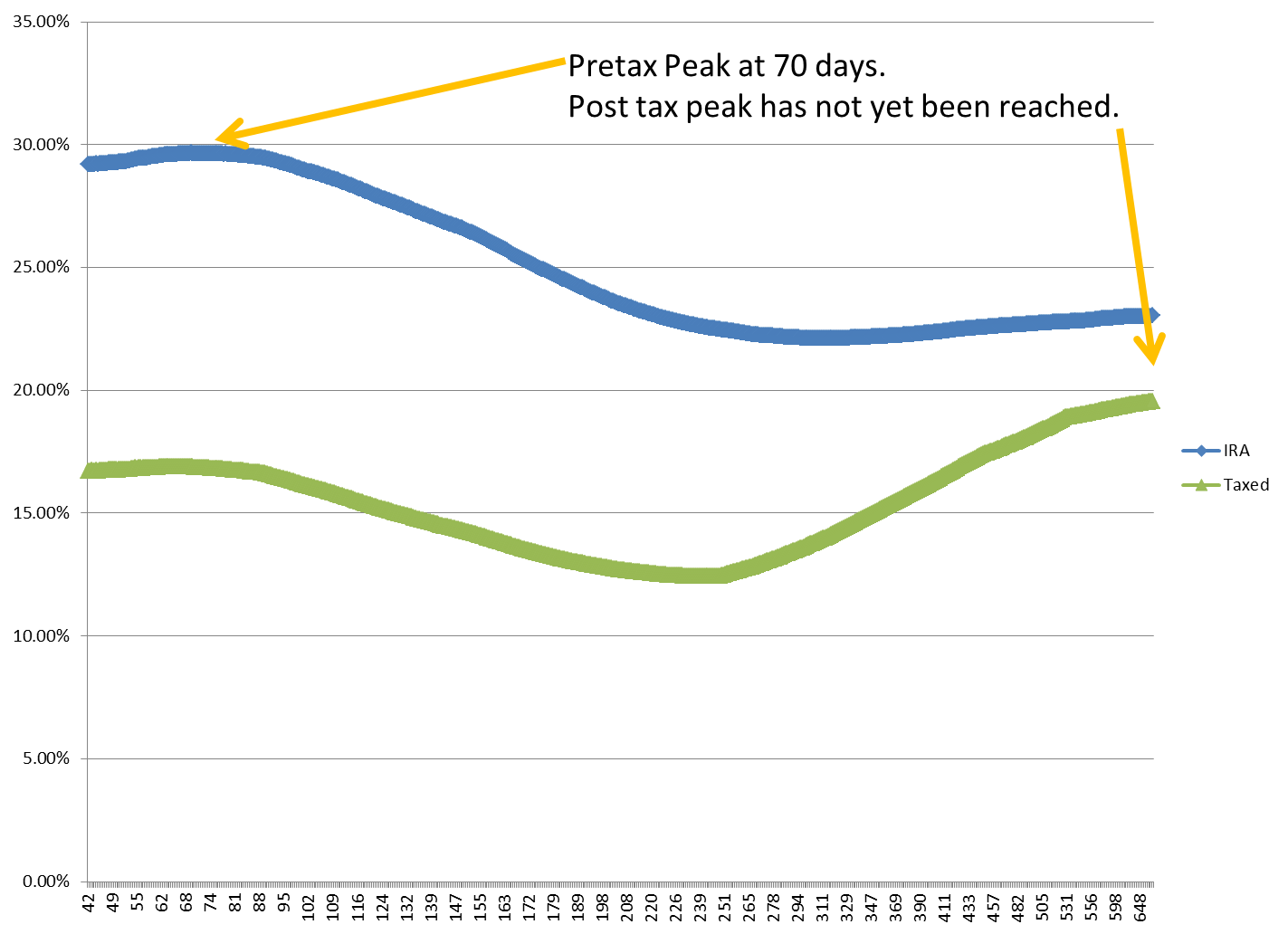

An IRA account would do best rotating one stock a week.

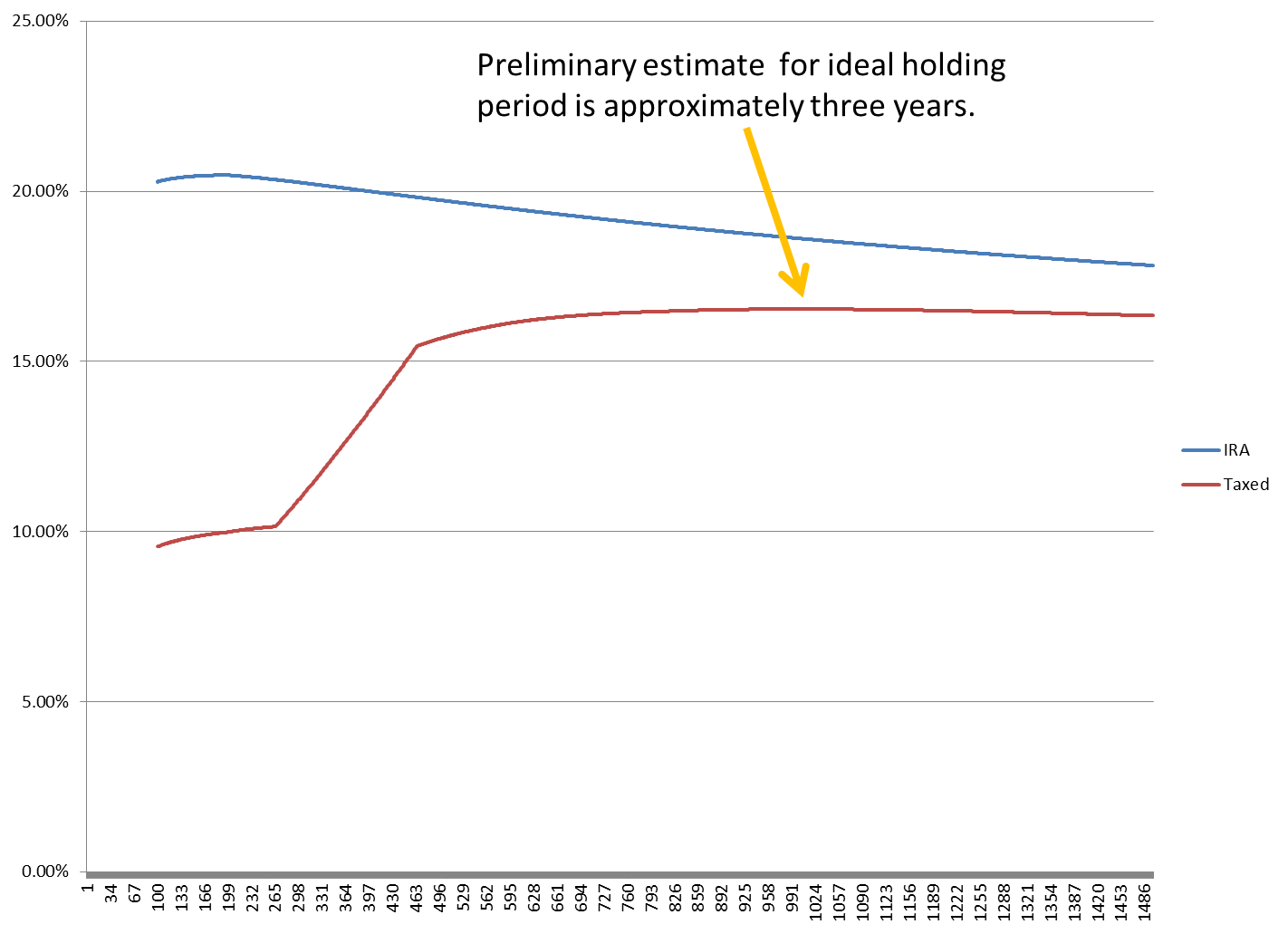

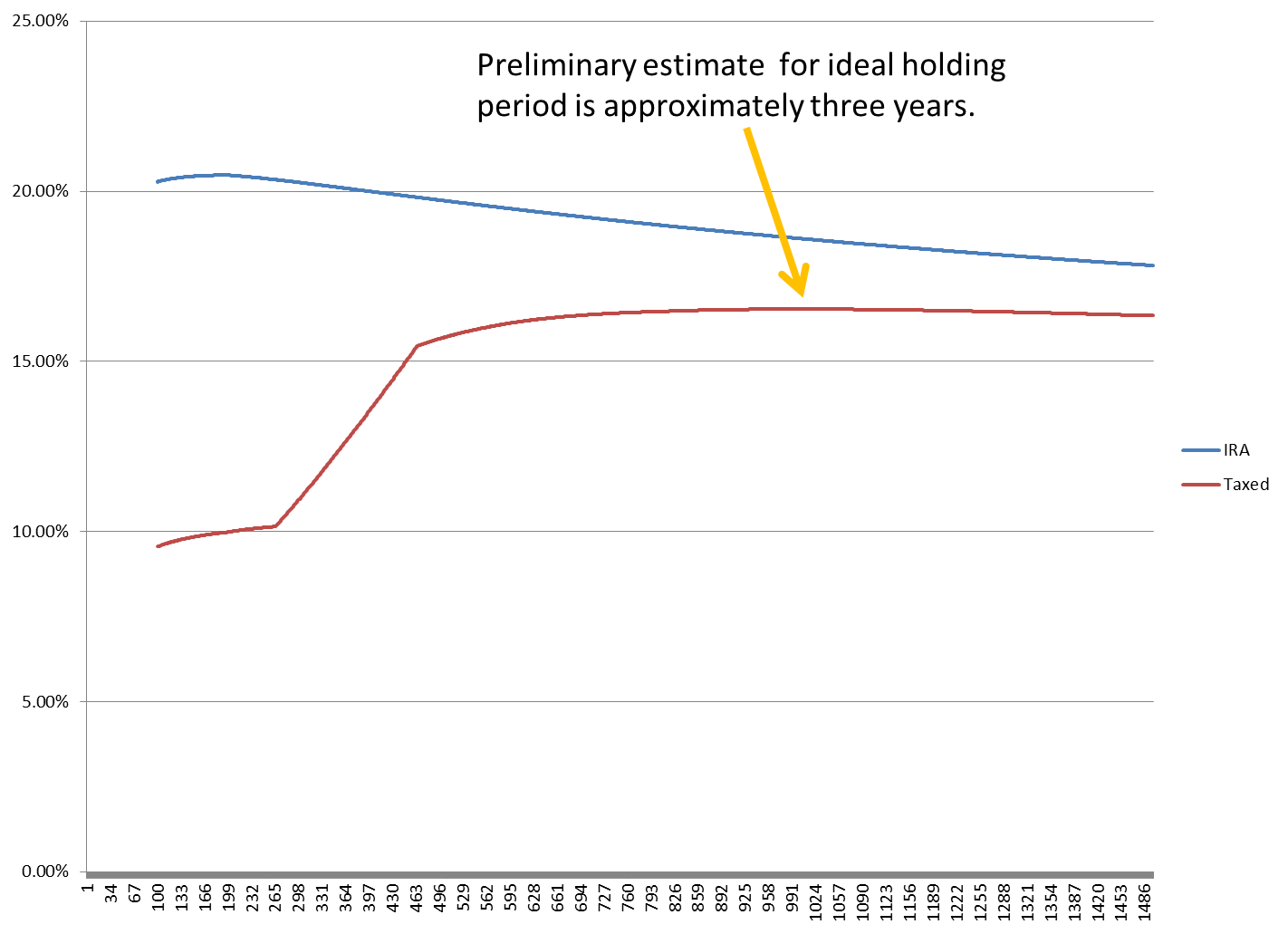

A taxable account would do better holding each stock well beyond a year. The model has been running for almost two years and has not yet found the sell point for a taxable account. I’m estimating a likely target of three years, but won’t know for sure until after 5/31/2014.

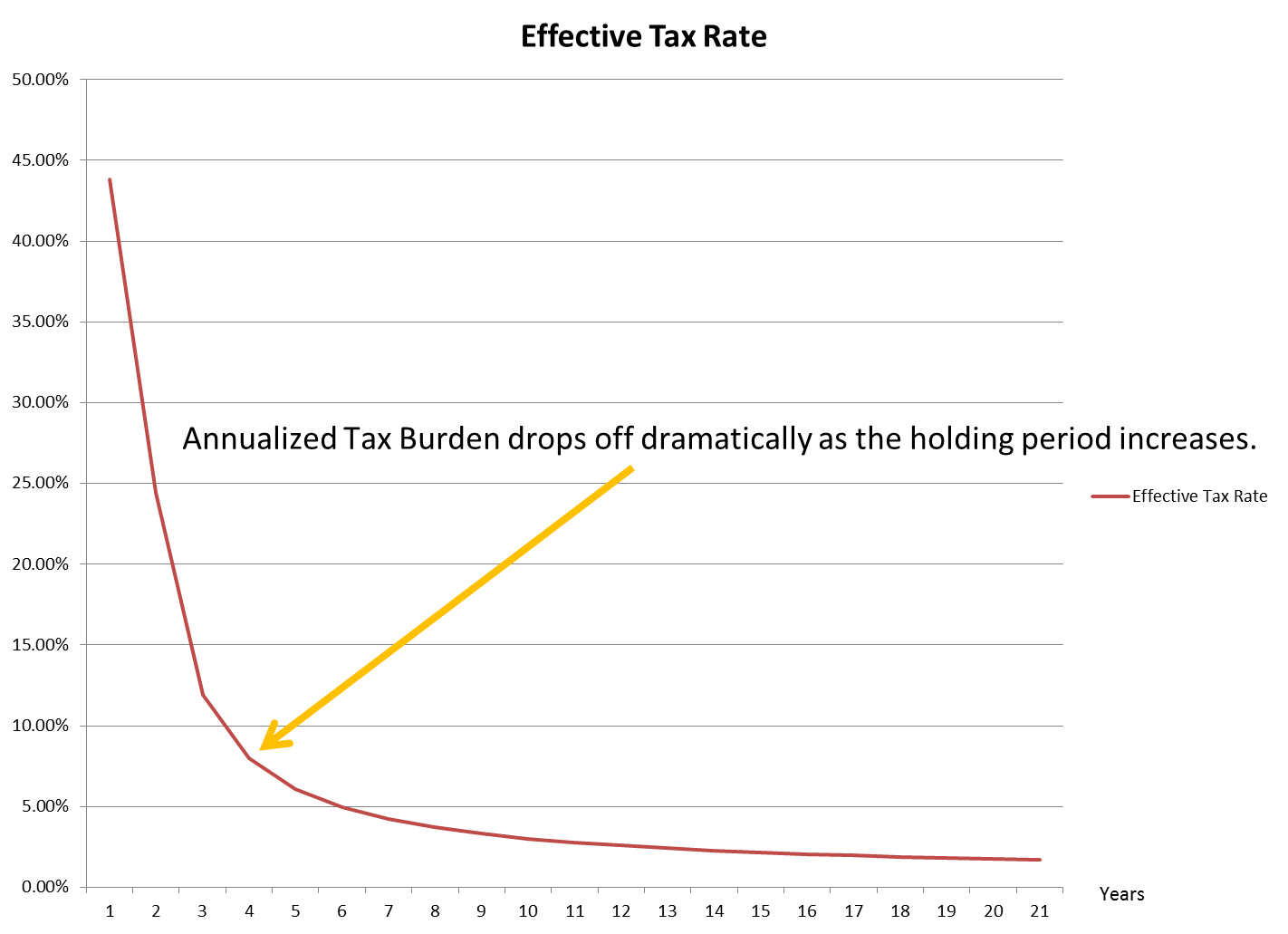

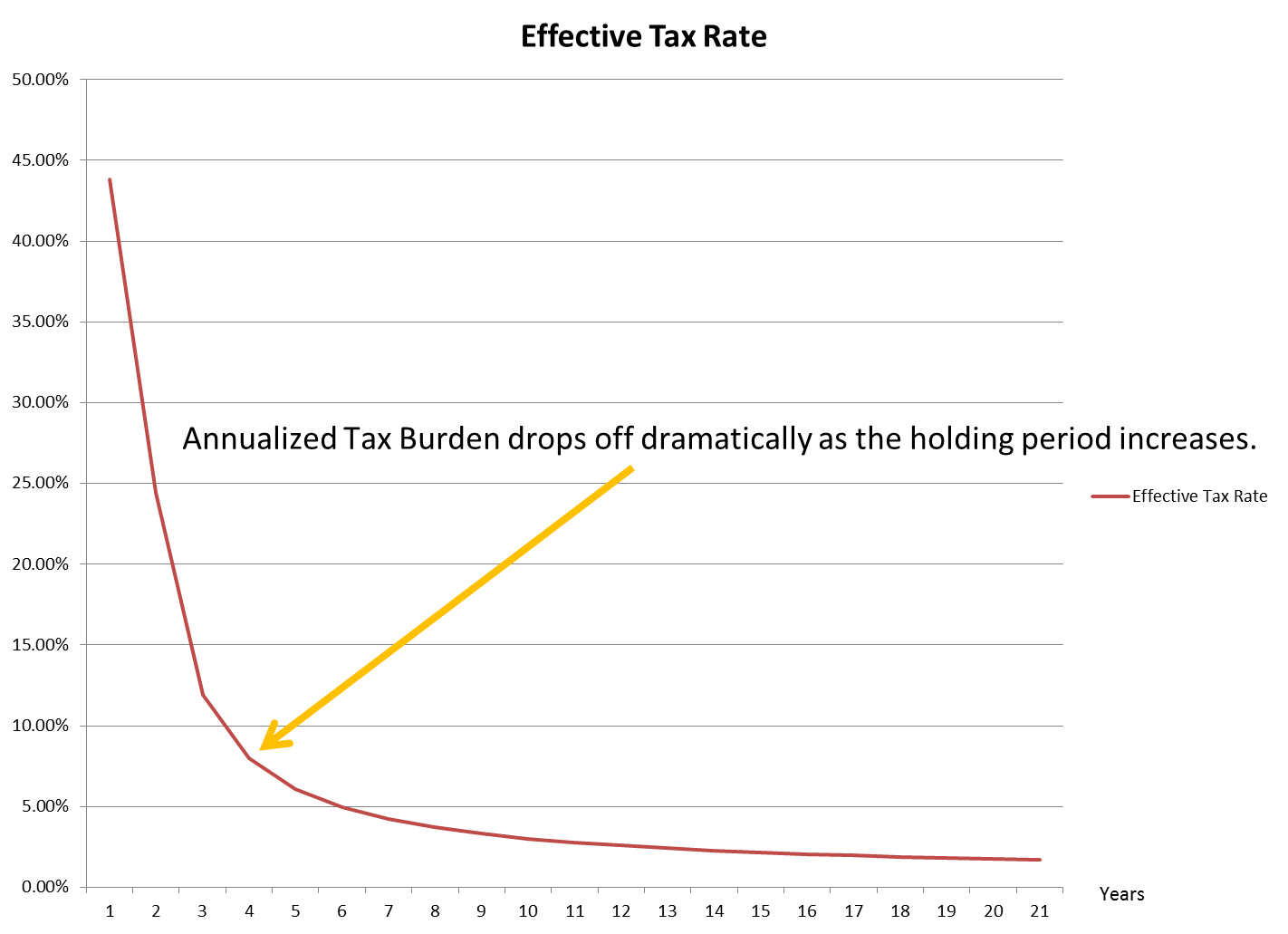

In any case, the reason for the difference is the annualized tax burden as a stock is held over longer periods of time:

In this chart, the reward / time ratio tops off at about 4 years. But performance on even the best stocks tends to taper off by 5 years. The action of both stock mean reversion and tax benefit is giving me a likely holding target of 3 years:

Note that this last graph is just a forecast (hence the slightly different percentages from the first graph). We won’t know until we get there.

Three years is a long time in the investing world, thanks to the Bush tax rates. But now that we’ve increased those rates the current average hold of 6 months will eventually stretch to 2 – 3 years, as it was in previous periods of high capital gains taxes. Remember, the average holding period is calculated per dollar, rather than per investor. Even if no one changes their investing behavior, the short term dollars will be taxed away and the bulk of the money will be left with long term investors.

I gave an example of how this works on a previous post:

http://market-mousetrap.blogspot.com...ible-hand.html

Can the technical configuration of the model be adjusted for these longer time periods?

No.

Not even close. No technical measure of breadth, volume, or price can have any meaningful effect beyond two years, and my model has a much shorter time horizon than that.

So is all hope lost?

Of course not!

Once you start counting in years instead of months, you’re in a purely fundamental time frame.

So let’s look at the FUNDAMENTAL differences between short term selections and long term selections.

I mentioned some weeks ago that the logic for the present fundamental filter is long term / short term. The model is looking for stocks that are currently doing worse than usual.

So, if a short term trade looks for long term clues, what the heck does a long term trade look at?

Cash Flow Growth 10-Year

Sales Growth 10-Year

Total Return 10-Year

Book Value Growth 10-Year

Dividend Growth 10-Year

This is pretty simple stuff. The longer your time horizon, the less you have to work. Long term investing is not some kind of esoteric science. There’s no need for a scalpel. A sledgehammer will do just fine.

Right?

Well…

Actually…

No.

Those, uh, fundamentals up there are not supposed to be “High”, but “Low.”

Remember, we DON’T want growth stocks. We want VALUE stocks. Value stocks are stocks that are beaten to a pulp, and if you want to invest long term, then you have to find stocks that have been beaten for a very long time.

Proj 3-5 Yr Relative P/E

Return on Common Equity

Return on Shareholders Equity

Proj Dividend Growth Rate

ROE Latest Qtr

Again, low, low, low, low, and low. You want stocks that have been beaten down so badly that investors are sick out of their minds at them and don’t want to touch them with a ten foot pole. Heck, even the 3 to 5 year prospects are bad, with a projected P/E that’s supposed to stay low years into the future.

Avg Trading Volume Last 6 Months

Again, low. This stock is a sleeper. People have even stopped trading it!

So, what the heck is GOOD about it?

It’s not good enough to find stocks with a bad decade. They might have another bad decade to go.

Remember that old long term / short term thing for the short term trading horizon? If you’re only holding a couple of months, you want a stock that NORMALLY does better than it is currently doing. To hold short, look long.

But now even the long term view is bad!

This is where it gets really weird:

Est % EPS Chg 2 Qtrs Out

Total Return 13-Week

EPS Latest Qtr

Est % EPS Chg Fiscal Year

Intangibles

All of these are high. You have a stock that has started to move in price, but with almost no volume behind it. The tell isn’t technical (i.e. volume).

The tell is fundamental – earnings.

The earnings are rising faster than the price or the volume. And they are doing better than they’ve done for the past decade.

Those of you who’ve read Peter Lynch will recognize this pattern. It’s one that hasn’t worked since the 1990s. But it’s working now.

Lynch made his reputation in the 1980s, when a secular bull market was pulling us out of a decade and a half of sickening stagflation. Companies that did horrible for the previous secular market were suddenly taking off faster than investors could keep up, and Lynch could ride some of these stocks to ten-fold increases.

I’m not saying we are in a new secular bull market. And maybe this is an aberration. But those who do catch the turn (IF this is a true turn of the tide), will do extremely well.

So, to invest long term, you don’t want something that usually does well but is having an off year. You want something that’s had a horrible DECADE, and is now picking up in earnings, with a small price gain on low volume – a sleeper.

To invest for months, look at years.

To invest for years, look at decades.

All of this bears further study, but it looks like I’ll have plenty of time…

Tim

Last edited by Timothy Clontz; 05-05-2013 at 11:14 AM.

Reason: Corrected Graph Sequence

-

Note on relation of my model and Pascal's

Pascal has a far more robust model than mine, of course. What I wanted to note, though, was that his model works on Effective Volume and mine works on a build-up of NON-effective Volume.

Basically he's showing when volume begins to affect price, and I work on a disconnect between volume and price.

Since the two models have different foundations, they don't work well together.

Right now my sector model is long XLB (the materials sector) and also long ABX (in the Gold mining industry). My sector model averages about a month for each trade, and ABX is designed for a little over two months.

The typical holding period for Pascal's models is much shorter.

Since our models do NOT work well together, my GUESS (strong emphasis on GUESS) is that any long positions on GDX may have some stumbling for a spell before working out. Short positions may start off well and then get stopped out.

Again, I'm just guessing here, but it's an educated guess based on a study Pascal did a while back on my model.

Tim

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote