-

11/24/2012 Mousetrap

Small Portfolio XLF & IAU 18.25%

Position Date Return Days

DECK 6/15/2012 -31.07% 161

RIMM 7/16/2012 60.83% 130

SEAC 9/25/2012 9.79% 59

CAJ 9/25/2012 3.84% 59

DDAIF 9/25/2012 -7.32% 59

CFI 10/31/2012 3.42% 23

CGX 11/5/2012 13.52% 18

MO 11/8/2012 6.62% 15

EL 11/12/2012 3.70% 11

BOKF 11/19/2012 1.00% 4

S&P Annualized 3.20%

Small Portfolio Annualized 12.30%

Large Portfolio Annualized 20.95%

From: http://market-mousetrap.blogspot.com...buying-re.html

Rotation: selling DECK; buying RE.

DECK has had its chance. Itís still a good buy, but RE is a better buy. Hurricane Sandy has had a good run in making the REINSUR industry a bargain for us, so itís time to test those waters.

But last week I promised a bit more on taxes.

So, taxesÖ

Regardless of the difference between the Bush and Obama tax rates, they do appear to have one thing in common: the short term rates are 20% higher than the long term rates in either scheme.

That makes the math easy, but itís not the entire answer.

Or perhaps I should say, itís not the PERMANENT answer.

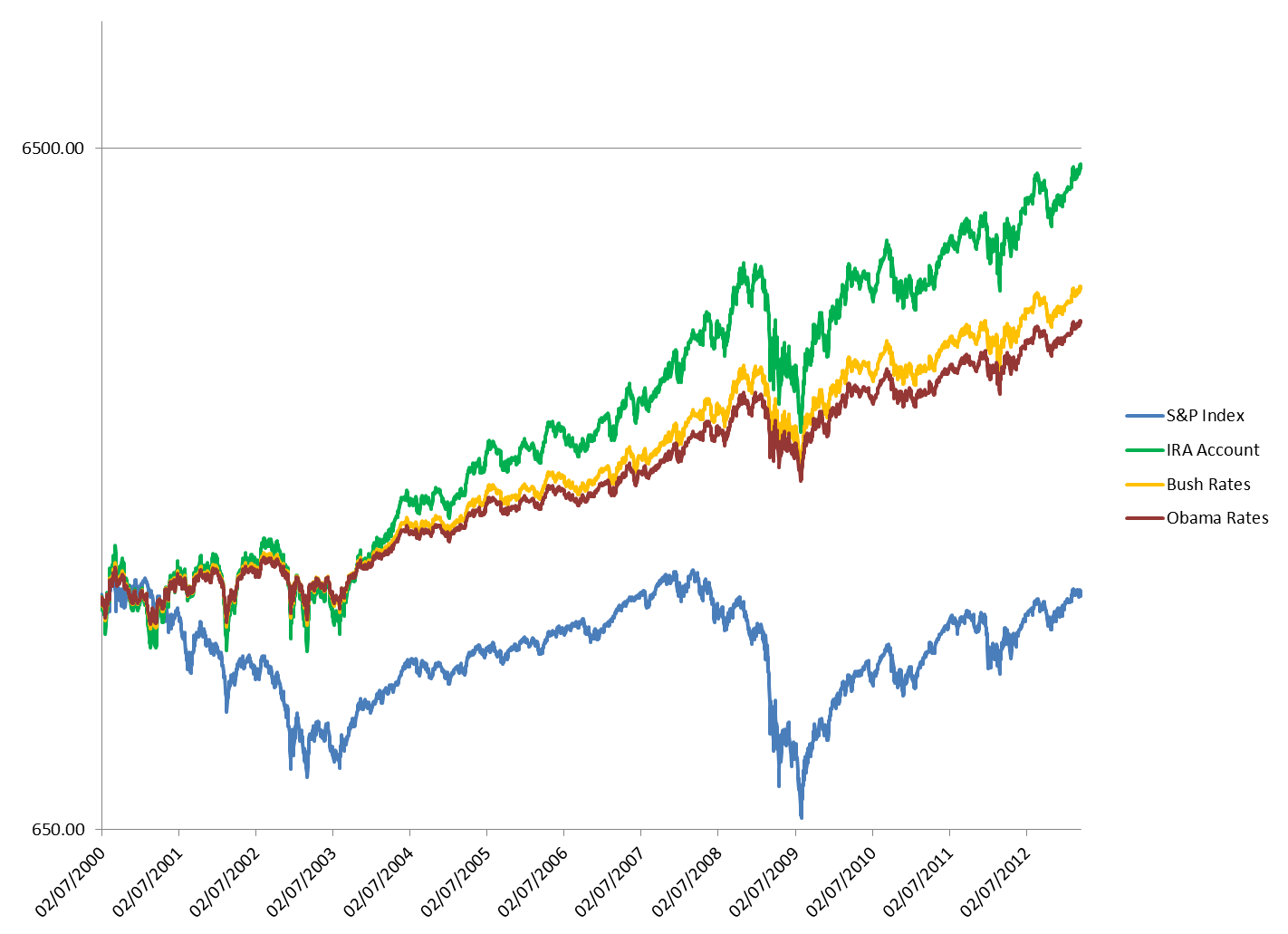

Hereís the graph:

Seems simple. The green line is the sector model in an IRA account. The orange line is the sector model after the Bush tax rates. The red line is the sector model after the Obama tax rates.

And while these are all profitable when the S&P goes nowhere for a decade, I do not yet know how profitable they will be when a new secular bull market begins.

Thatís not likely before 2020, so I have some time. Until then, my model should continue to outperform the broad market, even AFTER Obamaís tax rates take effect.

For now, itís good enough.

I hope everyone has enjoyed a lovely Thanksgiving with their family. Thatís whatís important. I like math. I love my family.

For a life, thatís more than good enough.

Tim

-

DECK

Tim,

For your timing, you should notice that DECK is the top 10-year performer among major retail stocks during the week following Black Friday. It averaged an 8.4% return in that week and has been positive the last nine years in a row.

Billy

-

DECK

Thanks Billy.

Waited to sell after the 5.25% pop today. Reduced my losses a good bit.

Last edited by Timothy Clontz; 11-26-2012 at 11:59 AM.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote