-

Index Cluster Weights

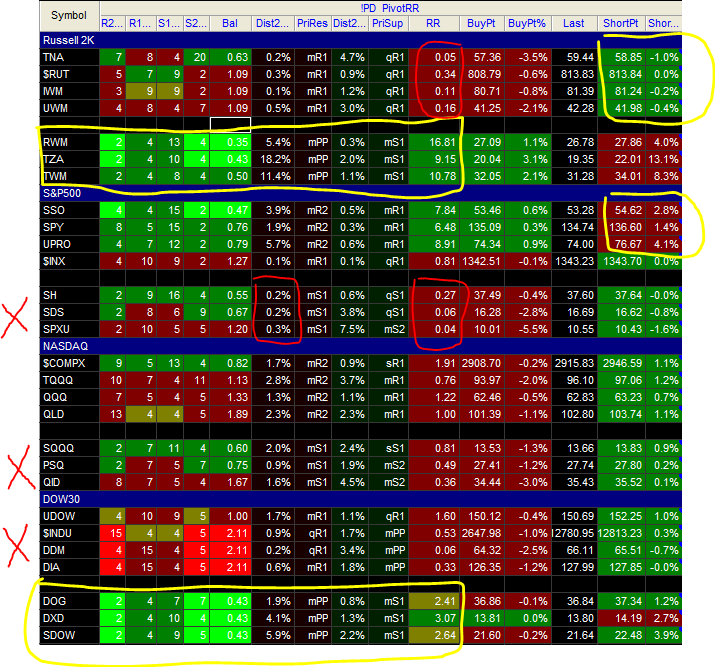

Here's the latest cluster weights for the major indexes and their tracking ETFs:

For those of you who want background, please read here and the entries prior to this link.

We have a mixed bag if you take these weights in isolation. The Russell 2K is indicating relatively poor risk/reward (RR), with all values below 0.35. When values are in the 2-4 range entry is favorable on the long side. In fact, if you look all the way to the right, the shorting RR values are "at zone".

Note what I call "zone breadth" for each of these ETFs. I define "zone breadth" as the calculated distance between the nearest support with a weighting over 3 and the nearest resistance with a weight over 3. TZA has a huge zone breadth -- 18.2% - 2.0% = 16.2% / leverage amt (3) = 5.4%. TWM has a 11.4% - 1.1% = 10.3% / leverage (2) = 5.15%. RWM is at 5.1%. These are healthy allowances for downward moves and are suggestive of favorable RR on the contra ETF side of IWM.

Once again though the S&P500 isn't confirming the Russell.

The S&P500 is caught between the monthly R1 and R2, right where John Person indicates is a normal, healthy location for a bull market. If you look to the far right, we'd need to move up +1.4% in the SPY from here in order to hit an optimal 3:1 shorting R/R point.

Further, if you look at the zone breadth for SPY, SSO, and UPRO, you can see that for the SPY we're at 1.6%, for the SSO we're at 1.7%, and for UPRO we're at 1.7%. This suggests, in isolation, that there is upside room available on the SPY and it's derivatives.

The NAS saw distribution yesterday, largely due to AAPL, and the zone breadth for the long side of the NAS is not supportive of entry. QQQ has a ZB of 0.2%, QLD is 0%, and TQQQ is negative. The shorting RR entry points are already "green", meaning we're favorable in terms of entry, so entry on any strength on the SHORT side could be a good bet. Note though that with such poor zone breadth it is quite hard to determine proper shorting R/R.

All of this is still work in progress, but is posted for your review and comment.

Regards,

pgd

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote