-

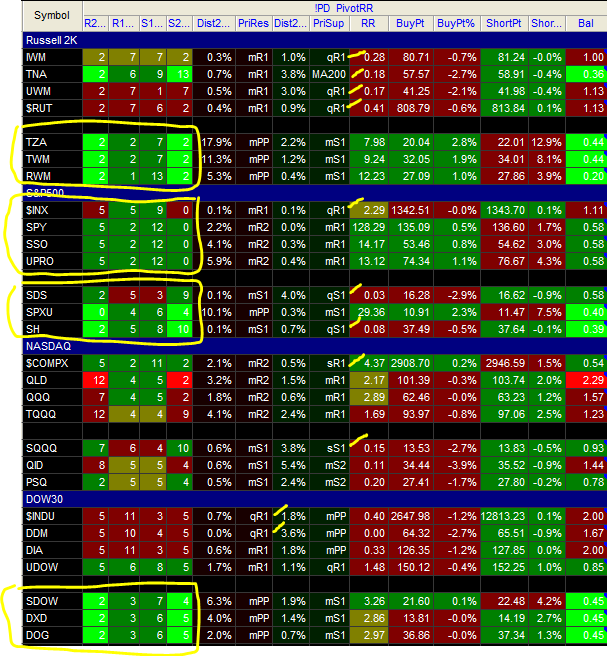

Index Pivots for Monday, February 13

Call this an experiment in real time -- I'd like to post some of the displays that I'm seeing so we can get a better handle on pivot/cluster grouping within the major indexes.

As many of you know, I've created a TradeStation indicator to implement the methods of Billy and Maxime (I borrowed some of Bob's code for the pivot calculations). Here's my presentation on the major indexes, related ETFs with their leveraged counterparts, as well as the contra ETF counterparts.

Here's a quick explanation of the columns:

R2, R1, S1, S2 as shown are the strength of the two clusters above (resistance) and below (support) the present price. This updates in real time. A cluster is defined as being 20xATR in width, e.g. an exponential 20d MA is used in the ATR calculation. The value listed in the column is based upon the strength assigned to whether the pivot level is a daily (1), weekly (2), monthly (3), 50d (4), quarterly (5), semester (6), 200d (7), or yearly (8).

Colors are indicated in the R2 .. S2 columns. Bright green indicates that the resistance clusters (R1 + R2) are at least 2x smaller than the support clusters (S1 + S2). In the chart TNA fits this, as (2 + 6) * 2 < ( 9 + 13 ). Conversely, bright red is the exact opposite, where the resistance clusters are 2x greater than the support clusters. In the chart QLD fits this description: (12 + 4) > 2 * (5 + 2).

Normal green in the R1 and S1 columns means that R1 < S1 (greater support). Normal red in the R1 and S1 columns means that R1 > S1 (greater overhead resistance).

Normal green in the R2 and S2 columns means that R1 + R2 < S1 + S2 (greater support). The converse in red means greater overhead resistance for both clusters.

Puke-green in a columns means equivalency -- the clusters are balanced and a great war is about to be waged (or not). IWM fits this description. Where the R2 and S2 columns are RED yet R1 and S1 columns are puke-green the war will be fought but resistance is futile, as the R2 cluster dominates.

============

Now, with the background in place, it's time for some real observations.

First of all, there is real power when the underlying and it's leveraged counterparts all sing from the same sheet of music. That is, all the clusters tell the same story independent of leverage. We ALMOST have this with the S&P500 -- the index symbol $INX is a bit of an outlier, but the SPY, SSO (2x) and UPRO (3x) are all in alignment. These three are suggesting a combined cluster weighting of 7:12, favoring a move upward.

Unfortunately, the Russell 2000 and the NASDAQ are not confirming this.

$RUT is the Russell 2k index. The combined cluster weighting is 9:8, so we're balanced. The IWM, which I take as my benchmark, is 9:9 or balanced. UWM, the 2x leveraged ETF is 9:8, just like the $RUT. Only TNA shows significant support and suggests a potentially strong move up. Remember though -- UWM and TNA are pinned to the performance of $RUT, so I personally discount TNA as an outlier and disregard. The R2K is not favorable in either direction going into Monday's action.

The Q's present much of the same picture. $COMPX has a combined cluster weighting of 7:13, but QQQ is 11:7 and QLD is worse at 16:7. TQQQ is bearish too at 16:13. Ugliness, with a bias to the downside on the Q's. Despite this, everything keys off of the $COMPX which is pointing upward more than anything else in this group, so time will tell.

================

Hence, from this presentation, it appears that we could see some strength in the S&P500, more weakness in the R2K and a coin flip on the NAS. I look forward to tracking this for a few weeks in the open for you to see if we can see some trends emerge using the cluster/pivot techniques.

Regards,

pgd

Last edited by grems8544; 02-12-2012 at 10:06 PM.

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote