I was so proud of myself for dipping a toe in at 3:10... and then along came 3:39....

It looks like lot of buyers came in at 3:59, didn't they?

We have all the symptoms of a major reversal indeed. VWAP was resistance early and for the first time at the last hour rally attempt. Some large players tried to buy at the lows but larger players were waiting to sell in ambush at VWAP. We are now right on support cluster. Let’s see what the robot settings will tell us tomorrow.

Billy (licking my wounds)

Billy,

It looks like Bob’s prediction happened regarding the failed bounce. May I ask if you were stopped out of your discretionary trade today? I say this as I’m still holding on and have indeed added to my TNA discretionary position this afternoon. I’m using the robot stop which seems so well positioned, however I’m curious to know if you were perhaps using the (65,5) volatility stop or something else on the discretionary side. Here’s hoping my wounds have a miracle cure and I don’t fall off the operating table tomorrow. Thank you for any comments. Always appreciated.

Dave

Dave,

I agree that Bob’s liquidity watch is the best I know and I am hoping like everyone else that he can soon become more RT active again.

I am still in my discretionary TNA trade and like you I don’t see a better stop than the current robot stop at 71.02. The 50 dma just rose at 71.09 and brings further cushion before a potential worst-case hit. Of course a sell signal from the 20 DMF is my other fail-safe stop.

As I said previously, barring being stopped out, my trade is intended for the “long run” and until stage analysis tells me to sell. Therefore, the volatility stop is way too short-term for such a trade. I am also a very aggressive trader and used to psychologically weather temporary large drawdowns when confident in a long term setup. I am aware that this may not be so easy for everyone.

That’s why we have the robot. And once again it proves to be a much better performer than my smartest discretionary trades!

Billy

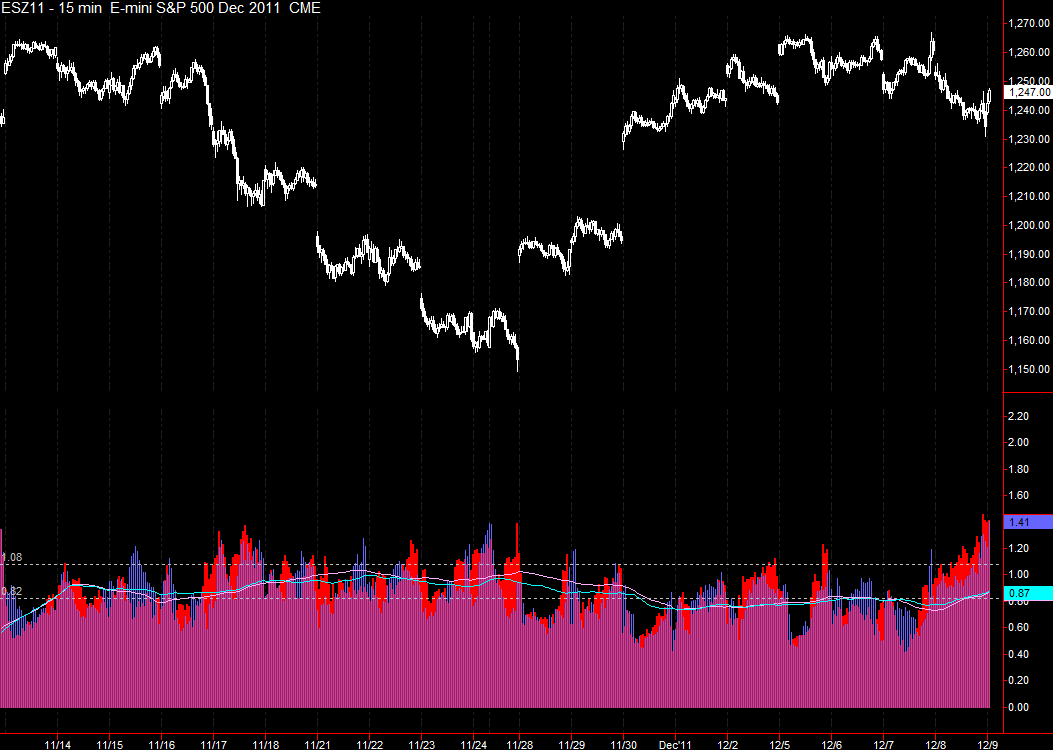

I just realized that TradeStation jumped into the illiquid March 12 contract for the ES yesterday...a full week ahead of schedule. Accordingly, I re-did the liquidity chart (higher = less liquid). At the approximate time of posting yesterday of 3:15 pm EST, readings would have been elevated, but did not take out prior trailing month highs until closer to the close.

It seems the market has no patience and will not wait long to try another escape from the box.