-

Update for Friday, September 30th

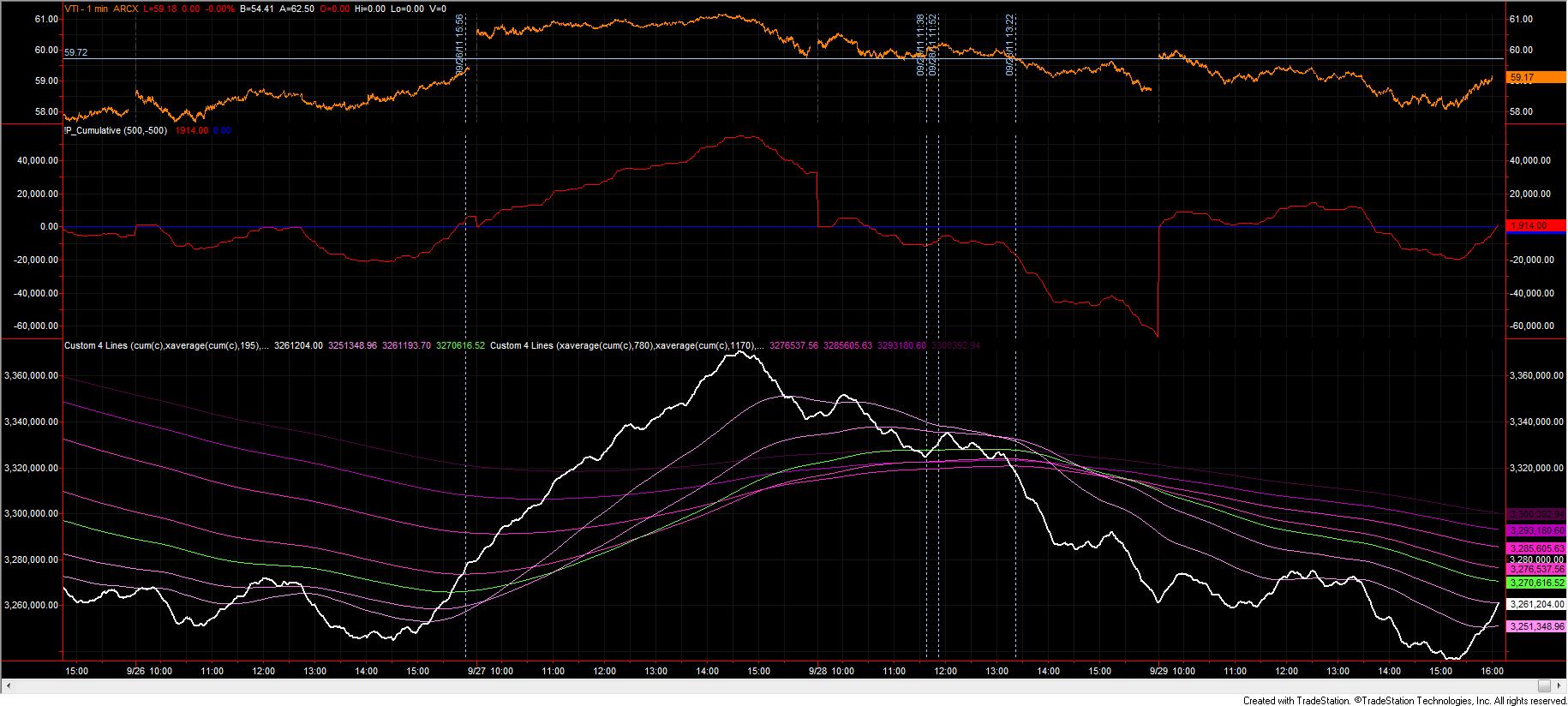

From a broad perspective, the buying algos turned on around 15:22 EDT and didn't let up through settlement at 16:15:

Note the steady reversal of the cumulative tick patterns in the middle and lower panes. Despite futures being down as I write this I'm watching for a penetration of the 10d cumulative tick MA from below as well as any form of slope change of the 10d MA (right now the 10d MA slope is down but becoming less so pronounced as the cumulative tick moves upward).

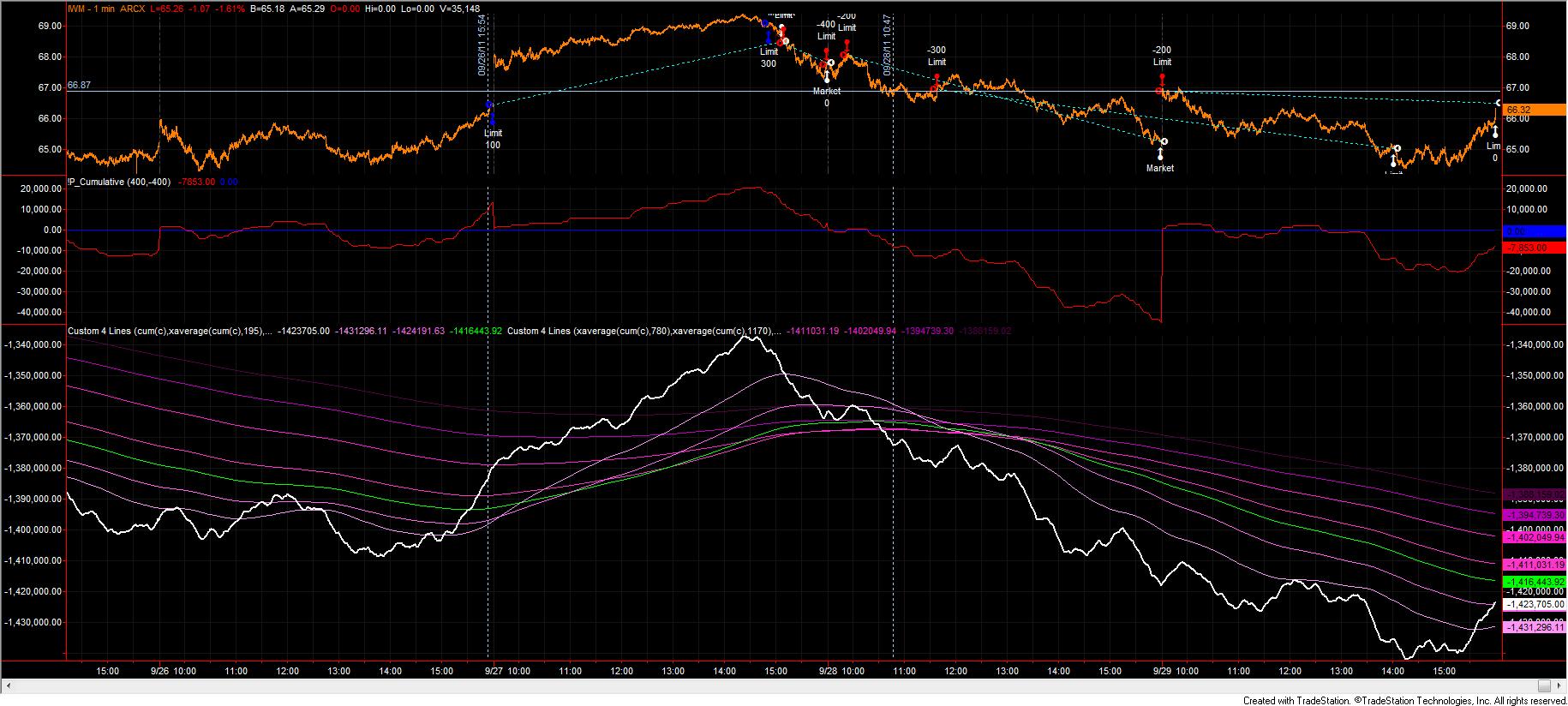

The Russell 2K small cap cumulative tick cleared the 1d MA without looking back, which nearly reversed the entire drop for the day:

Given that I will not be at my PC at market open this morning, and that the VIX is still way above 30, I decided to close my short IWM positions, as well as my long TZA positions at the close to lock in those gains. I can always get back in on the short side if warranted.

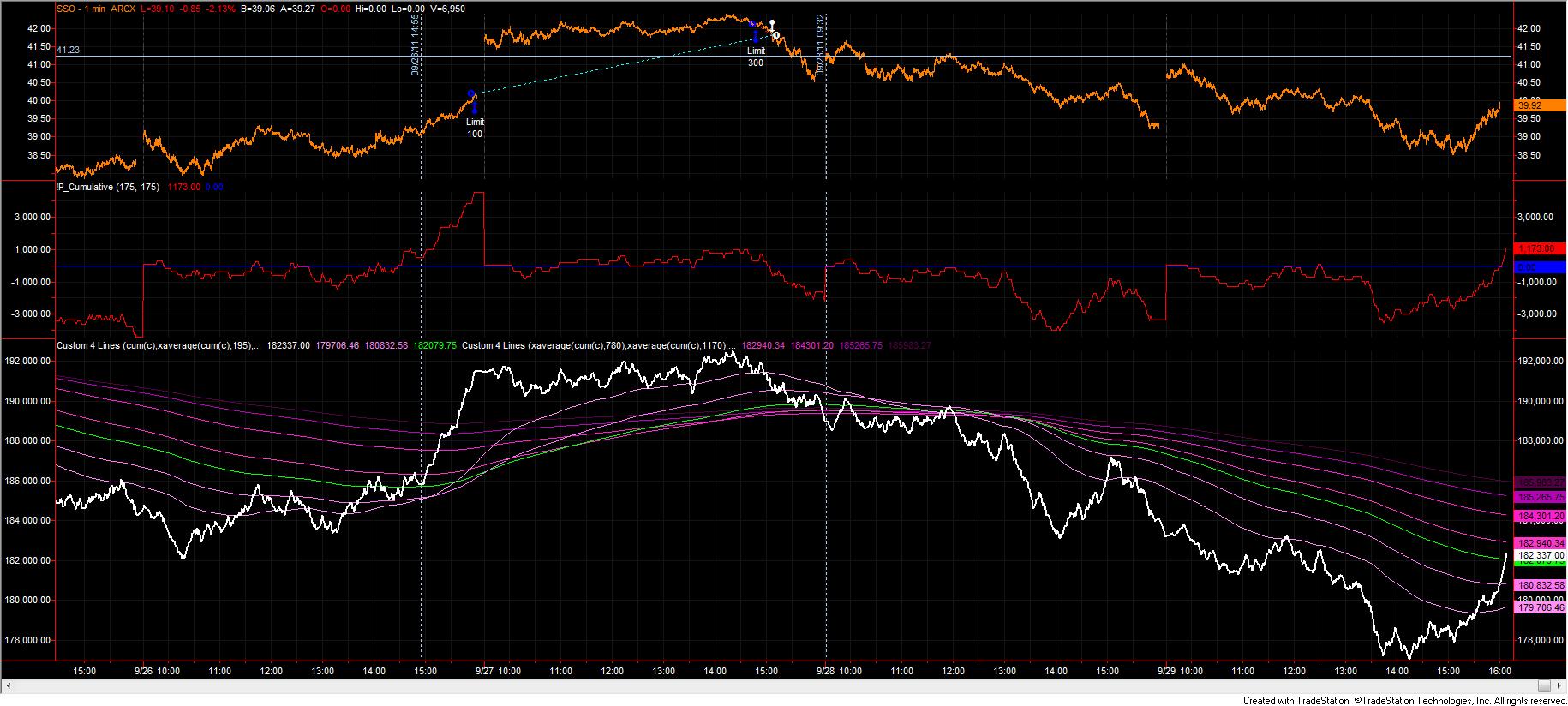

Somewhat ominous for the bears is that there was significant strength in the S&P500 yesterday, with the cumulative tick taking out the 10h MA from below.

This is a bullish sign that can be interpreted various ways:

- End of Month/Quarter window dressing in the relative "safety" of dividend paying stocks

- Movement to lower beta positions in advance of an anticipated (continued) down draft

- Methodology to employ capital where yields are higher than Treasuries

Supporting the end-of-day move was a reversal of sorts in terms of LEV into the SPY:

Note how the general down-draft in the most-liquid-ETF-on-the-face-of-the-planet reversed in the last 35 minutes .... Time to pay attention.

===============

My plan today with respect to the tick methodology is to

- Watch for a crossing from below on the $TIKRL (Russell 2K) small caps of the 10d cumulative tick MA

- Watch for confirmation across $TIKSP, $TIKQ, and $TICK of the same ($TIKSP is already there -- will it hold?)

- Enter base positions on the LONG side (SPY, IWM, QQQ) if momentum causes an inflection point in the slope of the 10h MA on each of the different indices.

I'll miss the first hour or so of the market this morning ....

Last edited by grems8544; 09-30-2011 at 08:44 AM.

Reason: Hit the send button before was ready :(

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote