-

Debriefing

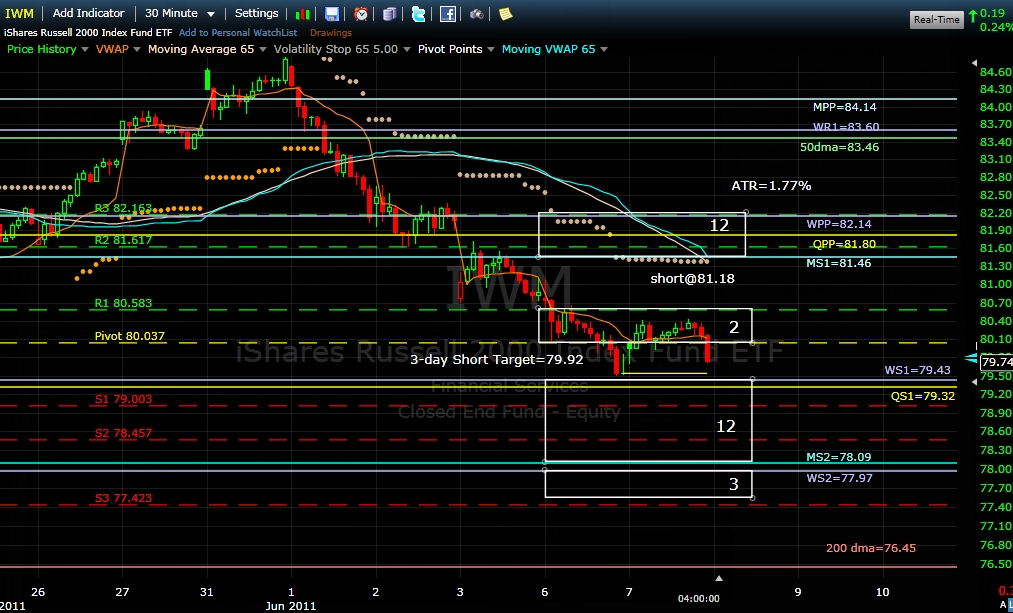

Not much happening with IWM yet. It is in the vicinity of its most probable 3-day short target (79.92) for the second day in a row, giving clues that there is not much potential left to the downside for the rest of the week. It hovered quietly all day around the daily pivot equilibrium and never tested its first support cluster. This is a subtle clue that market makers have probably covered their own short positions by now, something they always do before taking care of their client's buy orders. The weak close is manufactured to help them start tomorrow from a low price compared to all recent timeframes VWAPs. If they are indeed planning to accumulate for institutions at a good VWAP from here, WS1 (79.43) and QS1 (79.32) should hold as support tomorrow, and a realistic long target would be the 5-day VWAP or 65-period moving VWAP on a 30-minutes chart (81.48). Interestingly, it is declining and approaching the robot short entry limit at 81.18 which is not expected to change much tomorrow.

The GDX robot entered a new short position today at the open (55.28) above the limit entry price of 54.98.

The confluence of Yearly Pivot (55.19) and WS1 (55.37), right at the beginning of the first resistance cluster area, acted as a bumper and reversal zone, exactly as anticipated and confirming the current (slight) bearish bias for GDX. Contrary to IWM, the most probable 3-day short target (53.38) still offers good potential.

Billy

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote