-

Debriefing

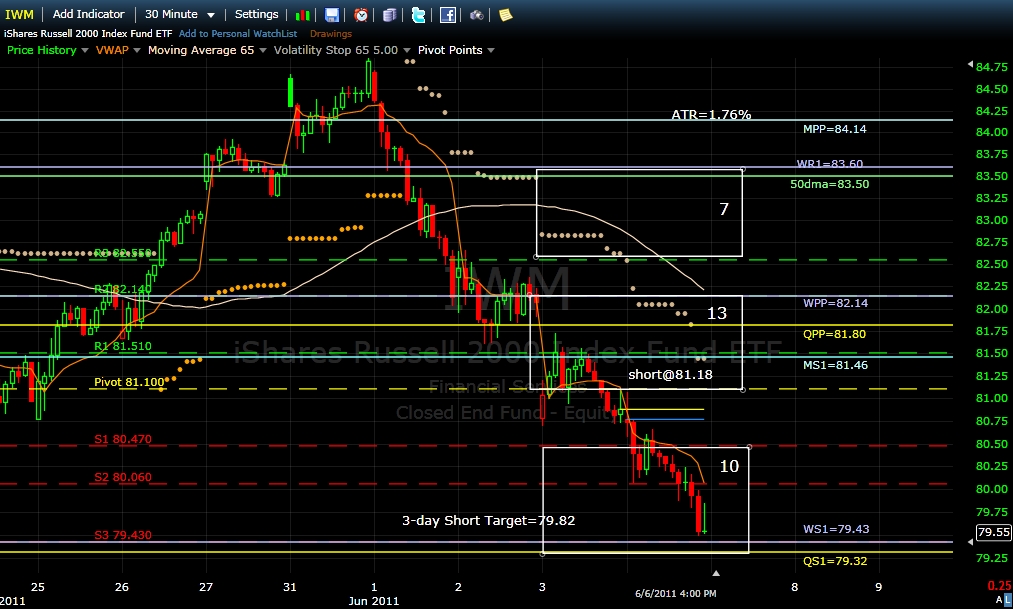

IWM refused to explore the first stronger resistance cluster which was marked by the daily pivot (81.10) and missed the robot short entry limit (81.18), by a few cents before falling across most of the weaker first cluster support down to the lower limit support of daily S3 and WS1 ( both 79.43), just above QS1 (79.32). The last hour of trading never touched DS3 and WS1, a sign that market makers might be scaling back in from these levels, opening the way for a bounce on Tuesday. The most probable 3-day short target (79.82) was overshoot in the process, so a very short term low may be in.

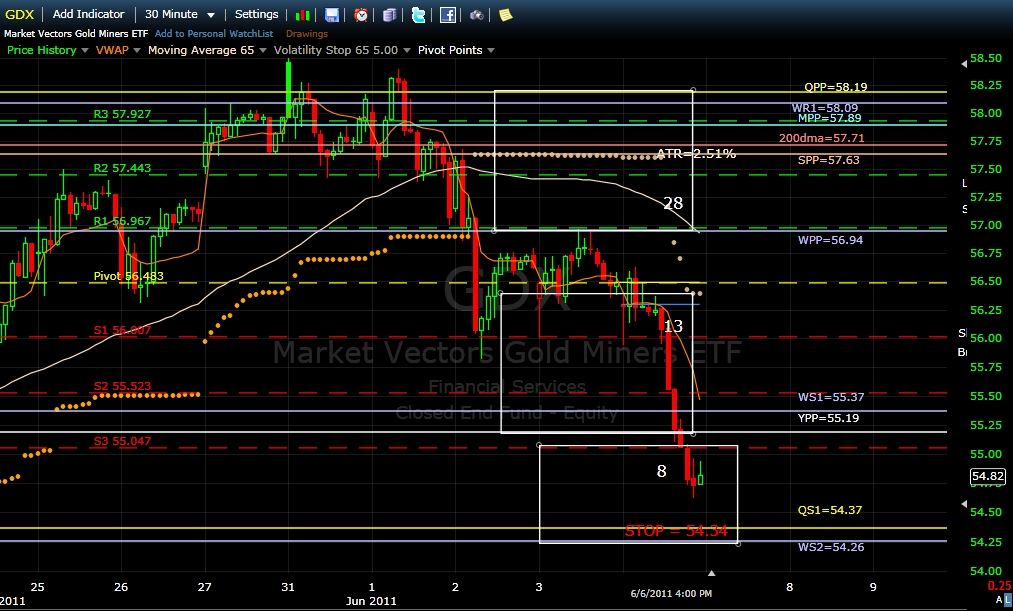

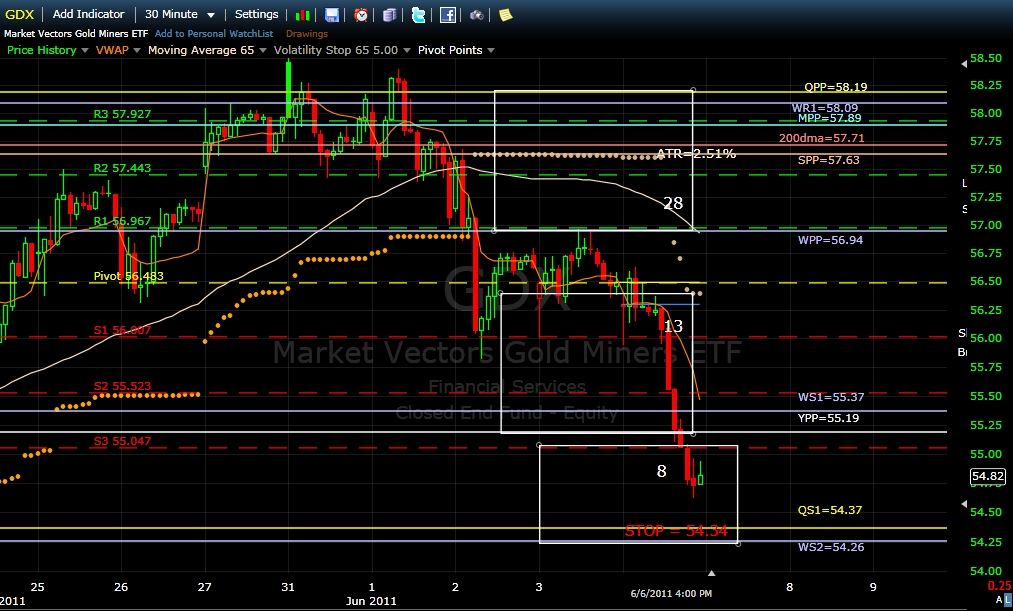

GDX followed its path of least resistance with conviction, falling through 1 ˝ weaker support clusters, ignoring the important Yearly pivot (55.19) along the way. The GDX robot issued a sell signal at the close, based on the GDX MF. The position will be covered at the open on Tuesday and the robot will search for entering a new short position. Billy

Posting Permissions

Posting Permissions

- You may not post new threads

- You may not post replies

- You may not post attachments

- You may not edit your posts

Forum Rules

Reply With Quote

Reply With Quote