Tutorial: Setting Price Targets

This is an advanced topic.

Historical studies of leading growth stocks show that starting from a new bull market cycle that leading growth stocks breaking out of their first base often top 18-months to 2+ years later. In CANSLIM investing we typically pay zero attention to P/E when we buy a stock. However we do make use of it to help determine if a stock is in a possible topping zone. Typically a growth stock expands it first-stage breakout P/E by 130% before it finally tops. Often 130% works well but this is not an exact science, in 1997 the top 10-percentile leaders expanded P/E by 318%. 1997 was an exceptional year.

So the procedure is to first identify the first base breakout. We actually spend some time determining when institutions are entering and not just pick any base. Typically a breakout out of a base when the price is above $10 is in the institutional buying zone. 2009 was a strange year with institutional activity below this price. I look to see how many funds own a stock as well as inspect earnings and volume for obvious signs of institutional activity. Once I identify the instutional-quality first-stage breakout I determine the P/E at that time. I either have to find the prior 4-quarters of reported earnings per share to do this or use a shortcut of looking it up in an old financial newspaper. I keep all electronic copies of Inverstors Business Daily back to January 2003 for this purpose.

Next step is to access future expected earnings estimates 18-months to 2-years out from that 1st stage base breakout. The price target is computed by adding 130% to the first-stage base P/E and then multiplying that figure by the estimated future annual earnings to achieve the target topping zone price. Multiplying the P/E by 2.3 is the same as adding 130% to the P/E...

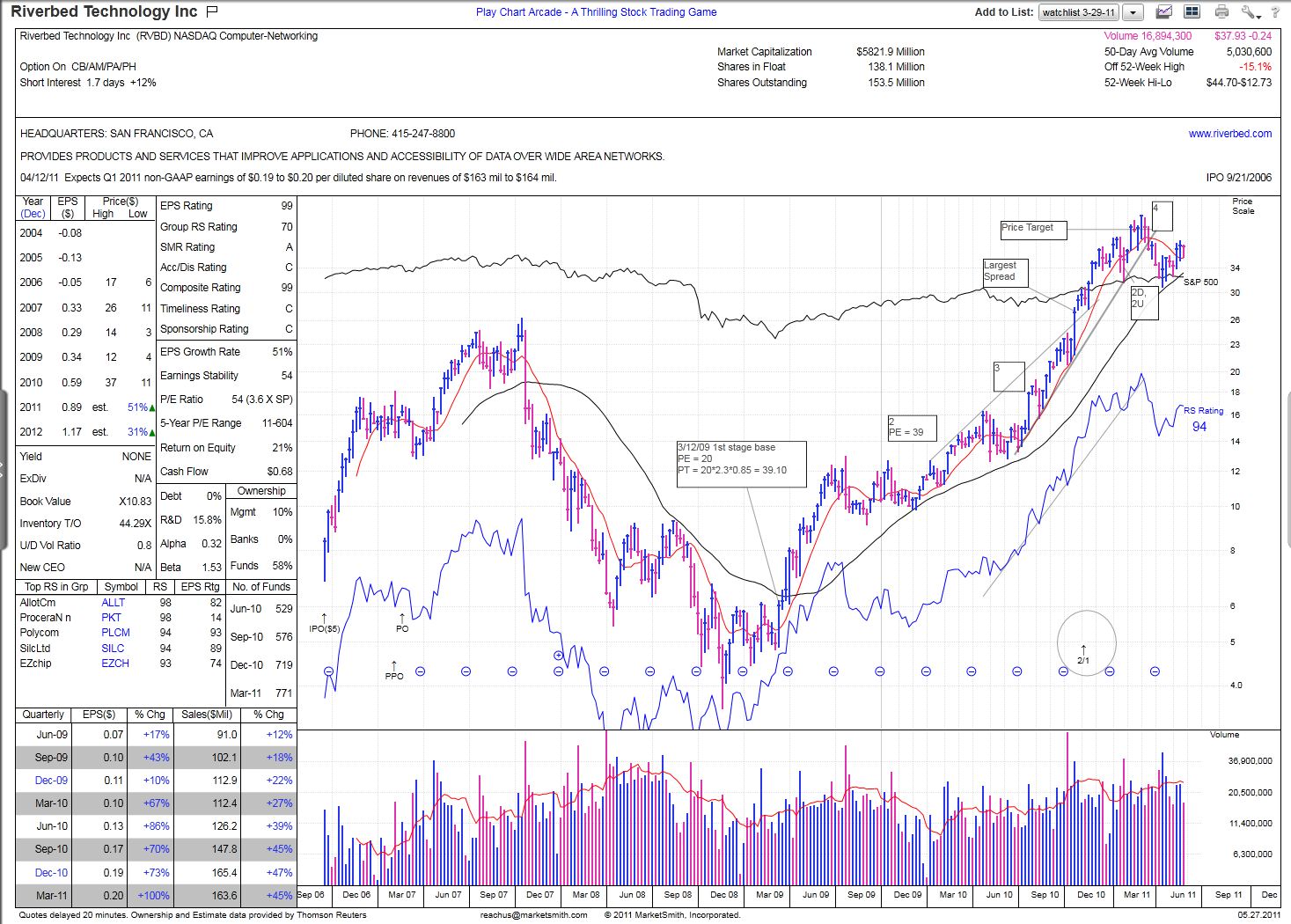

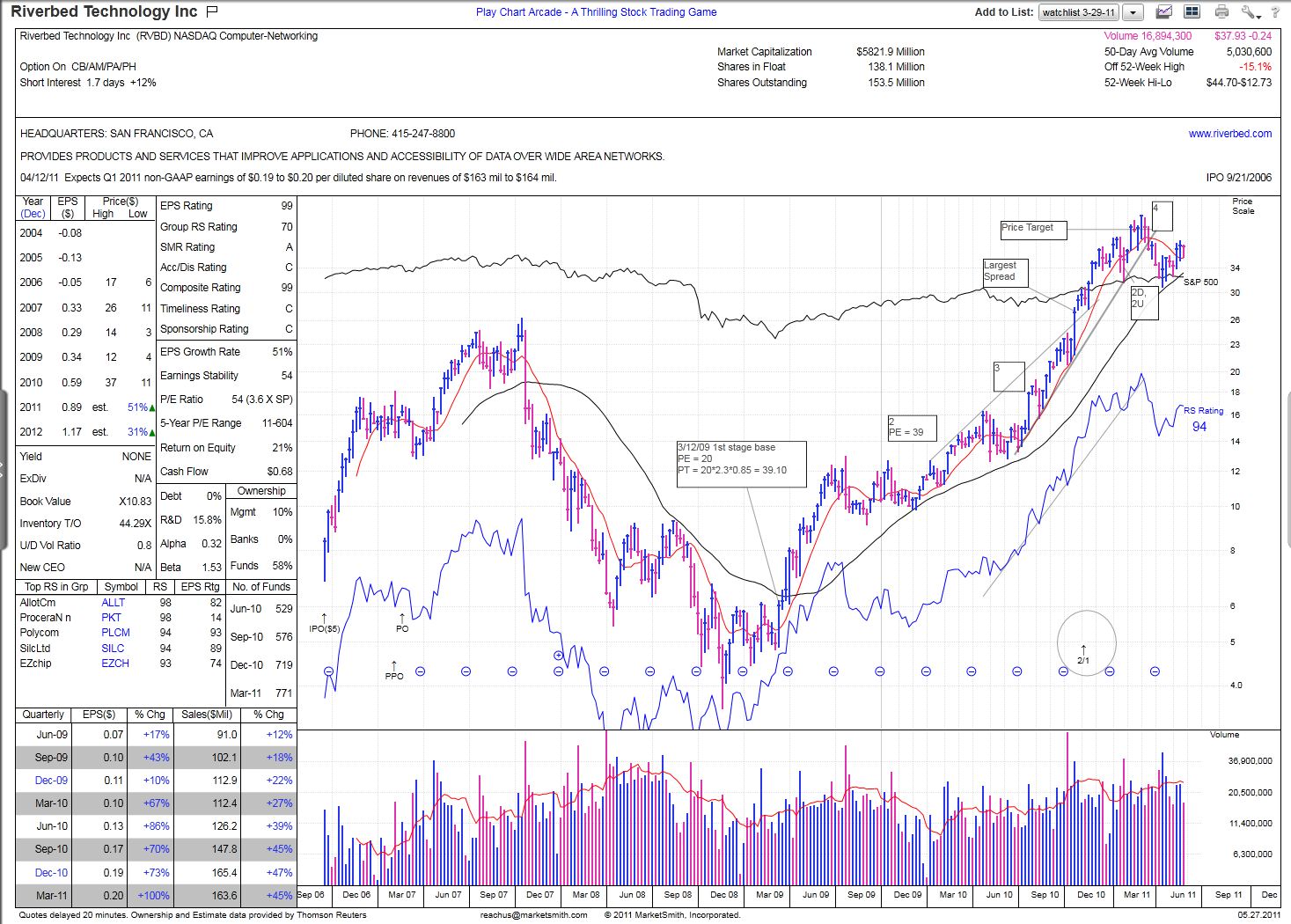

So lets use an example with Riverbed Technology, symbol RVBD...

The image below shows the chart and I have embedded the calculation on that chart. You may have to scroll your window to see the whole chart as it is pasted full size. I identified the first base breakout in March 2009. RVBD began its leadership at the same time that the general market signalled a new bull market. This chart shows RVBD price below $10 at this time but take note of the 2:1 split that happened in 2010, the price at the time was actually above $12. The computed price target was $39.10 using the then $0.85 forward EPS estimate in 2011. Since then the forward EPS estimate for 2011 has been increased to 0.89 which you can see on the left hand side of the chart in the data boxes for year 2011. I generally don't try to chase these numbers as they are modified but you can do so with a little bit of optimistic risk to your numbers.

On the chart I marked with a line and a box the approximate 39.10 price target. You can see that RVBD penetrated this line by about 14% and began what looks to me like a possible topping process with a 4-th stage base. It could be forming a head and shoulders pattern now although I find a potential flaw in that reading as the down volume on the right side of the head may not be adequate for a reliable read.

With knowledge of a future price target you can decide to have sticky fingers with a holding that you may have a substantial profit in with knowledge that the run up is probably not finished. Of course Mr. Market can and will have the final say on when the runup is done.

I annotate charts like this for my own use. Right now I have 596 charts marked up in this fashion so that I don't forget important details.

Mike Scott

Cloverdale, CA

Reply With Quote

Reply With Quote